Here's an update to the posting 15 May 2009: OSK Said Buy Lion Industries. Target Price 1.90

On 28th Aug 2009, Lion Industries reported its fy 2009 Q4 earnings, Quarterly rpt on consolidated results for the financial period ended 30/6/2009. It lost another 78 million, bringing full fiscal year losses to 276.871 million.

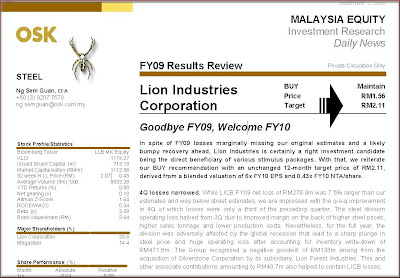

It was one bad year and OSK was quick to focus on it.

Hmmm... price target now 2.11?

Recently on 24 Nov 2009, Lion Industries reported its fy 2010 Q1 earnings. It made some 69.752 million. Sign of earnings turnaround?

This is what OSK said in its write-up. (Strange it did not give a price target uplift!)

Note that OSK does notes the earnings contribution of Lion Forest and Parkson to Lion Industries bottom line. (Yeah the complexity of Lion Group listed companies)

Do note that Megasteel shareholding in Lion Industries, and in Sep 2009, "Lion Industries Corporation’s (LICB) major shareholder and sister company, Megasteel SB, has proposed to dispose of 102m ordinary shares of RM1.00 each in LICB, or 14.31% of equity interest in the company, via the Option Agreement (OA) with Tan Sri William H.J. Cheng. The disposal consideration of each LICB share will be based on the 10-day weighted average share price of LICB Shares preceding the exercise date of the put option pursuant to the OA." source OSK (LOL! Yet another complicated deal. Megasteel needs cash due to its 1 Billion debt obligation! I wonder who it would benefit.)

Anyway, I decided to take a look at Lion Industries balance sheet.

One thing I like to note is the progress in a companies balance sheet. For example, if a company said it is making a lot of money, I like to see some wealth creation in the form of increasing piggy bank cash. And needless to say, I would personally prefer to see reduced debts etc etc.

Here's Lion Industries cash balances.

Are you impressed? I am not.

Here's the cash flow.

Are you impressed? I am not. This is the Q1 earning and yes, I do see some debt re-payment but cash drainage was quite drastic. Don't you think so?

Last fiscal same period, Lion Industries had total debts of 1.366 Billion. And as indicated with the debts repayment in Lion Industries cash flow, Lion Industries total debts had decreased to 1.211 Billion.

So what I am looking at is a company with cash balances of 589.517 million and a total debts of 1.211 billion. If you are a potential investor, would you be comfortable with it?

Of course, some would be quick to point out that Lion Industries is in the steel industry and in this industry, most companies do carry huge loans and usually massive capital expenditure is required.

That's so true and that's perhaps why also some do not go ga-ga over this sector. It's simply tough to make decent money in this sector and not helping is the unpredictable price cycle of the sector products.

Last but not least, as stated many times before, I am not keen and certainly not impressed to see our local companies investing in quoted securities. Why? We usually have no good information on what exactly is invested in and such activity is not conducive to good business practice. Yes, what should the CEO focus on? The stock market or the company business? And honestly, I see no reason why I should invest in a company, only to see the company invest in unknown investments. Not my liking.

And Lion Industries also have quoted securities investments.

Ah, surely you be asking what securities?

LOL! Exactly! This is the issue, yes?

And given Lion Industries financial position, should it be investing in quoted securities???

Well take a look.

From Lion Industries own earnings notes, it states that its quoted securities (dunno what securities) had been purchased at cost of 89.849 million!!!!!!!!!!!!!

Its current market value? 42.621 million!!!!!!!!

Duh!

So do you think that Lion Industries should be investing a massive 89.849 million in quoted securities???????

Do you think 89.849 million is some small change?

how?

6 comments:

I apply 'Value Investing'

Some may see it, some not.

I like Lion Ind very much, esp when it's price coming down to 1.20 something.

I will continue to accumulate.

Hmmm...

I wonder why the need to announce to the world your investment intention?

:)

Oh yeah, value. Such a nice little word.

Who's to argue that there is NO value?

Every little thing do have some form of value.

:D

KC,

let me addd. :)

do realise that this is just a blog, so there's no need to prove to me or anyone else on your investment.

If you think you are right and if you think there is value, who am i to say you are wrong?

me? i only recall these two questions: "Who do you value a business you do not fancy or trust?" Is there a need to do so?"

Just to exchange an opinion !

Regards!

The company's debt is high and I would try to trim exposure rather than accumulate. Remember the recent Dubai fallout?? There is some form of asset bubbles forming in the world, when the interest rate mechanism is applied later, it will choke this type of company.

However, it maybe good when the rotational play comes.

Rather ironic.

Almost a decade ago, Lion Group of companies got into severe problems during the Asian Crisis.

And the main issue was too much debts.

Now?

Has anything changed much?

Post a Comment