On the Edge on 1st Nov 2010: Changhuat faces suspension over failure to submit statements.

Yesterday: Changhuat seeks more time to issue audited accounts

- CCB, a producer of plastic products, said the delay was due to a change in auditors for all its subsidiaries on Dec 7, last year. The delay was also due to audit findings tabled following its audit committee meeting on Oct 29, which required confirmation from third parties and reports by valuers, solicitors and bankers.“Subsequent to the appointment of the new auditors and pursuant to the commencement of their audit review plan for FY2010, the new auditors requested to be appointed auditors for all subsidiaries of CCB which comprises eight companies,” the company said in the filing.

- Bursa Securities said on Monday, Sept 6 that the limited review must be performed by the company’s external auditors for four quarterly reports commencing no later from the company’s quarterly report for the financial period ended Sept 30, 2101.

It also said the company had to ensure all its directors and the relevant personnel of the company attend a training programme in relation to compliance with the Main Market LR particularly pertaining to financial statements.

Bursa Securities said the company had breached paragraph 9.16(1)(a) of the Main Market LR concerning Aug 28, 2009 announcement on its fourth quarterly report for the financial period ended June 30, 2009.

It said the 4Q09 report failed to take into account the adjustments as stated in the company’s announcement dated Oct 6, 2009.

“The company had reported an unaudited loss after taxation and minority interest of RM7.02 million in its 4Q09 as compared to an audited loss after taxation and minority interest of RM4.96 million in its annual audited accounts for the FY ended June 30, 2009.

“The difference of RM2.058 million between the unaudited results and the audited results for FY ended June 30, 2009 represents a deviation of approximately 29.3%,” it said.

The deviation was mainly due to the overcharged depreciation cost for vessel in a subsidiary where the company did not recognise the residual value in the computation of depreciation in the unaudited results.

However, the interesting issue of course was what happened to Changhuat back in Sep 2009: On the Star: Changhuat Corp unit eyeing O&G deals

- At the EGM, shareholders approved the proposed acquisition by Changhuat’s wholly-owned subsidiary, Changhuat Manufacturing Sdn Bhd (CMSB), to acquire the remaining 37% stake in ADSB comprising 7.4 million RM1 shares from Ahmad Akmal Hamzah and Lim Kian Boon for RM26mil cash.

On Sept 29, 2008, CMSB completed the acquisition of 63% equity in ADSB for RM45mil.

The shareholders also approved Changhuat’s proposed disposals of the entire stakes held in Changhuat Plastic Industries (Senai) Sdn Bhd and Changhuat Plastic Industries Sdn Bhd to Wong Koon Sang and Lim Chung Kian for RM23.10mil and RM5.08mil cash respectively.

Effectively, Changhuat is chang-ing itself from a plastic player into an oil and gas player.

As per that Star article...

- ... Meanwhile, group managing director James Lim Lai Huat said the company made a right decision to venture into the O&G sector as the plastic injection moulding segment was becoming less attractive.

He said the profit margin in the manufacturing business had declined since 2002 due to the softening demand globally and increasing market competition especially from plastic injector moulders from China and Vietnam...........

Now what was most interesting for me... was the disposal of their plastic injection moulding business.

On 11th Nov 2009, Changhuat made the following announcement: PROPOSED DISPOSAL BY CHANGHUAT CORPORATION BERHAD (“CCB” OR THE “COMPANY”) OF ITS SUBSIDIARY COMPANIES, HENG HUAT PLASTIC INDUSTRIES (S) PTE. LTD. (“HHPI”) AND CHANGHUAT PLASTIC INDUSTRIES (RAYONG) CO. LTD. (“CPIR”) TO WONG KOON SANG AND YEAP KAH WU

- On behalf of the Board of Directors of CCB, MIMB Investment Bank Berhad wishes to announce that the Company had entered into 2 separate conditional Share Sale Agreements dated 11 November 2008 each with Wong Koon Sang and Yeap Kah Wu (“Purchasers”) for the disposal of its subsidiary companies, namely, HHPI and CPIR to the Purchasers for a cash consideration of RM1 and RM2.8 million respectively together with settlement of inter-company loans of RM29.3 million owing to the CCB and its subsidiaries

Cash consideration of rm 1 and rm 2.8 million respectively together with settlement of inter-company loans of RM29.3 million owing to the CCB and its subsidiaries????

Funky! Was my the first word that came to my mind.

Now before I read the sales in detail, I thought I make a quick click thru the earnings. Changhuat's previous quarterly earnings was made on Aug 2008: Quarterly rpt on consolidated results for the financial period ended 30/6/2008. It lost some 11.664 million!

Here's the compiled earnings table back in 2008.

That isn't a too hip of a company, yes?

The company made the following remarks on why so lousy earnings.

- The Group's revenue for the reported quarter of RM 26.082 million was RM3.15 million higher than a revenue of RM 22.932 million reported in the corresponding quarter of last financial year. A loss before taxation of RM 9.088 million & gross loss of RM2.581 million recorded for the 4th quarter of 2008 were RM7.759million & RM2.581 million higher than the losses in the corresponding quarter of last financial year. This was mainly due to the written off and provisions provided for slow moving & obsolete stocks, bad debts, doubtful debts and long brought forward deposit totaling to RM7,546 million. This was arrived from the group's annual review of stocks and debtors which taking into consideration of the factors such as uncertainties in economy and softening in plastic part prices. Therefore, to be on the prudent ground, the group decided to take precautionary measures, and provided such written off and provisions . The appreciation of SGD & Ringgit Malaysia further worsen the situation by resulting a foreign exchange loss of RM0.92million for the group in current quarter.

Provision of slow moving and obsolete stocks and bad and doubtful debts caused some rm 7.546 million in damages.

And what's most interesting was, Changhuat's balance sheet did NOT show the intercompany loans mentioned. Here's the link to the pdf file: CCB Qtr4 2008-Qrtly a'nounce(27th Aug).pdf

Back to the disposal of plastics: ( See here: Ann CCB - Final.pdf )

- two (2) separate conditional Share Sale Agreements dated 11 November 2008 (“SSAs”) each with Wong Koon Sang and Yeap Kah Wu (“Purchasers”) for the disposal of all its foreign subsidiary companies, namely, HHPI and CPIR to the Purchasers for an aggregate cash consideration of RM2,781,587 (“Proposed Disposal”).

- The Proposed Disposal, together with the settlement of the Inter-Company Loans, is expected to generate gross proceeds of RM32,081,587 to the CCB Group arising from the aggregate sales consideration of RM2,781,587 and Inter-Company Loans amounting to RM29,300,000.

Gross disposal proceeds if include all these 'inter-company' loans is rm 32.081 million!

WOW!

Ok.. leaving the issue that Changhuat was so not transparent at all for not disclosing these inter-company loans, my initial reaction was since Changhuat had been doing rather badly since 2000, the gross disposal proceeds seems rather 'generous'.

The inter-company loans:

- The Purchasers jointly and severally agreed with CCB to procure and ensure that the Inter-Company Loans shall be settled in full by the HHPI Group and CPIR to CCB for CCB itself and on behalf of CCB Group (other than the HHPI Group and CPIR), in cash in the manner as set out in paragraphs (c) and (e) below. The amounts of the Inter-Company Loans agreed to be settled by the HHPI Group and CPIR to the CCB Group are RM12,800,000 and RM16,500,000 respectively.

Now HHPI was sold for rm1.00! And HHPI inter-company loan was rm12.8 million.

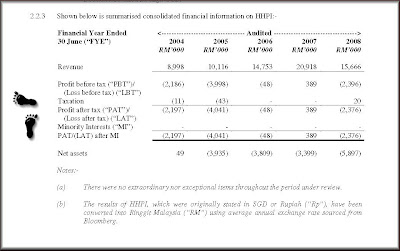

And from the announcement, here's how HHPI was doing...

Ahem... HHPI has been doing rather lousy hor. And don't you think the disposal price appears rather generous?

And here is CPIR financial performance...

How?

Here's Changhuat most recent earnings report: Quarterly rpt on consolidated results for the financial period ended 30/6/2010

The updated numbers..

Fast forward back to present day: Changhuat faces suspension over failure to submit statements and Changhuat seeks more time to issue audited accounts

How?

Me?

I really do not understand what's happening at all.

0 comments:

Post a Comment