My Dearest Mike,

Regarding Megan Media.

There is this old blog posting I have made before. It's called Price Versus Value.

I believe everyone understands that the current stock market is rather hot. Some would go for the hot stocks, while some were search the market for the low PE stocks - the laggards. But do understand there is risk involved in such a strategy. And since as mentioned, this advice was given to you, perhaps you might want to consider a second opinion on the advice itself. What if such an advice based on such a strategy could be faulty? Do not get me misunderstood here at all. I am not saying that all low PE stocks are bad and neither am I against this strategy at all.

But I believe there is risk involved here. And if not reasoned out carefully, such advice could turn deadly. This is because of the tendency of folks to be focused solely on the price of the stock. And sometimes they focus solely on the earnings, without giving a second thought about what is the driving factor behind the earnings. And by doing so, they simply focus on the price of the stock being traded on the market and they simply failed to understand the value of the company.

Simply put, a stock selling on a cheap PE does not equate that one is investing on a quality company. Sometimes, these stocks are selling at a cheap PE has a simple reason. They are cheap because the markets simply do not rate the stock at all due to all the inherent risk involved in the company. In simpler and cruder terms, they simply know that the company is lousy.

So what's so wrong with Megan?

Now, I have always believe and agree very much that investment is most sensible and intelligent when it is business like.

Now let's look at the issue of the quality of the earnings company.

Fy2005, Megan reported earnings 66.167 million. Company was in a nett debt of 557.526 million. Now get this, Megan's earnings actually increased by a whopping 15.325 million a year ago. But despite increasing so much, its nett debt position went from 371.092 mil to 555.526 million. An increase of 186.434 million.

Now think as a businessman, does it make sense to increase you nett debt by 186 million just to earn 15.325 million more?

Let's look at fy 2006. Megan ended its fiscal year earning only 60.234 million. Nett debt grew to 779.568 million.

Now assuming you consider that it was ok for Megan to ram up its debts in fy2005, to get that extra 15.325 million in profits, what about fy 2006 end figures? Earnings flat but nett debt is now 779.568 million! Which is an increase of 224 million!

Ok.. now this where good reasoning is important. If anyone or any business borrows so much money, don't you want to see some end result? And in Megan's case, where is it?

Now take current ytd fy 2007. See What about Megan? Current ytd net profit 3 quarter is only 39 million. Which is slightly little bit more than its previous year same quarter of 36.7million. Nett debt is now a whopping 863.329 million. Nett debt has increased another 83.761 million so far this fiscal year.

And again, consider yourself as a businessman; do you want to be a business partner of such a business? Since fy 2004, Megan nett debt has increased from a nett debt of 371.092 million to 863.329 million. An increase of 492.237 million!

Does it make sense?

Ask yourself this. If your best friend shows you such a stats, would you want to be his business partner? Would you? In the most logical manner, don't you reckon that your friend has no idea on how to manage and run his business?

See if one asks these simple questions in a rational manner, you simply take focus of the stock price out of the equation. And it's so crystal clear that as an investor, it does not make any sense to be a business partner of such a business!

The following passage in the blog posting, Price Versus Value, is worth remembering:

Buy the Value, sell the Price! Most shareholders only watch the movement of stocks but forget to understand the value quality of a company.

- To understand the quality of a company, the first step is to look at its financial conditions such as the levels of assets, liabilities and cash.

- Moreover, we have to look at its business competitiveness in the market, its competitors and its earnings outlook.

- More importantly, we have to look at the vision, ability and integrity of the management.

- If a company treats its shareholders badly, it is better not to touch its shares.

There is this other blog posting: Megan: Part XIII

Let me reproduce it here again.. >>>>

In Part XII , I have made the following statements...

- For me, I believe that an investor's primary objective is to invest in only the good, quality companies at a reasonable price. And if that is the case, then the share price or the market reaction to the company's earnings is not in the equation. For the focus is always on gauging the quality of the company. ( If one puts the share price in the equation, the investor focus gets muddled because the likelyhood is that the investor might be focused on what the share will do in the market, will the share go up or will the share go down. And the actual focus on the quality of the company is soon forgotten. )

Ah... in the share market, can it work if one merely focuses on the issue of the quality of a company?

Now before I continue, I have to ass-u-me one thing, and that is, me and you, the reader of this blog posting, we believe in investing. It makes no sense to continue reading if one believes otherwise. Right?

So as investor, do you believe that the main objective is to invest only in the good company at a cheap price?

And if so, the key issue is always on the quality of the company. And needless to say, if the company is NO LONGER GOOD, then it makes no sense that we continue to stay invested in the stock, right?

Now, how am I going to prove this issue to all?

Ah, for those that really knows me, I have simply been a big bad bear on Megan (and ... LOL... they are bored stiff reading my comments on Megan!)

Since when?

Well... I believe since 2003... since the very day, Megan decided to play that funky corporate music by purchasing MJC, a funky corporate exercise that saw Megan purchasing MJC, a company owned by its own majority shareholder.

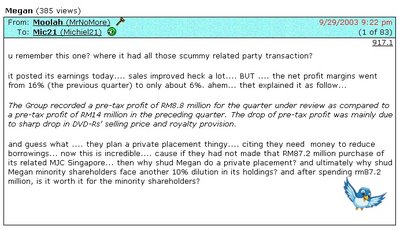

Let me prove to you. Have a look at this screenshot of an old chap-lap forum. (the forum is closed hor).

That was posted on Sept 2003.

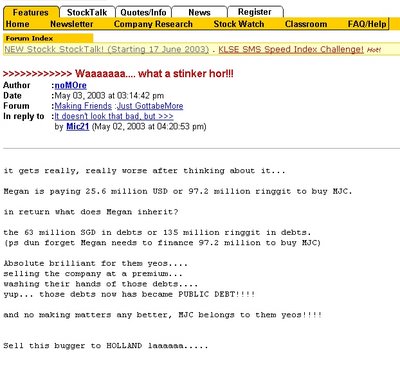

And here is another proof. Click here or have a look at the following screenshot. (Click on the picture to have a bigger view)

That was posted in May 2003.

The opinions back then, was the Megan shareholders was using the company as a tool to enrich themselves. They, the Singaporean shareholders, used Megan Media, a listed company in Malaysia, to purchase a company in which they have own vested interests. And they sold the company at a premium and with the sale the existing debts of MJC were sold to Megan.

As mentioned before, when I purchase a stock, I consider myself being a part owner of the business. A business partner. So when my business partner places their ownselves before me, how could I trust being a part owner of such a company? And most important of all, do I see myself benefiting in such a partnership? Can meh? How can I benefit when the owners main priority is to enrich their ownselves?

Hence, how would I rate such a company? How can I possibly value a company that I cannot trust?

Is it wise to buy and hold such a stock forever and ever?

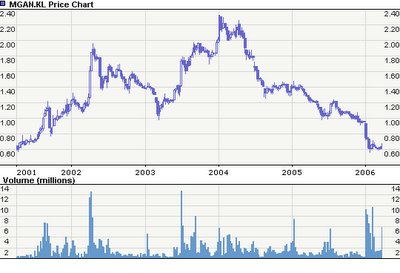

Take a look at this Reuters chart. (do try to verify the accuracy of the chart hor...)

How?

Three worthwhile things to note...

Firstly, I have mentioned many times before (it would be too tedious to prove this also) that there was some real justifications to invest in Megan but this was in 2001. And as can be seen in the chart above, the early investor would have been rewarded nicely for their investment in Megan.

Secondly.. when Megan played their funky music in May 2003, wasn't it a good time to exit the investment?

Was May 2003 a good time to decide to AVOID/EXIT/STAY AWAY from Megan Media?

Ahh... as can see clearly from the chart, perhaps May 2003 wasn't the perfect time to exit Megan and that perhaps maybe Jan/Feb 2004 would have been a better time to exit Megan.

Yup.. it wasn't perfect.... but.... heyyyyyyyyyyyyyy..... was it shabby to exit Megan back in May 2003?

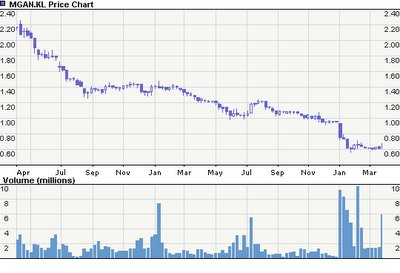

Lastly, buy and hold... if the company quality is no longer good.. is it wise to HOLD and HOPE that it becomes better? Well the best answer for that question is to look at this chart below.. see the devastating result for holding and hoping?

Ahh... yes... some could argue that all this is nonsense and irrelevant already because this is all past. And it's really make no sense to constantly looking at the rear view mirror when one drives... right?

So what lies in the future for Megan?

How will happen to the share price?

Ahh... let me say this again... I have no idea... but as an investor... my issue is simple.

How do I rate the quality of this company?

Now consider these issues.. the depleting cash, the rocketing debts, the rocketing inventory and the extreme high level of trade receivables, the integrity of the management...

and now we have the issue of how Megan accounts its profits (ie the issue of the depreciation rate)..

how? how do you rate the quality of Megan? Do you even think that Megan is an investment grade stock?

If no... why should you bother with the share price?

:D

----------------------------------------

Now from that blog posting, here is another issue for considertion.

- The opinions back then, was the Megan shareholders was using the company as a tool to enrich themselves. They, the Singaporean shareholders, used Megan Media, a listed company in Malaysia, to purchase a company in which they have own vested interests. And they sold the company at a premium and with the sale the existing debts of MJC were sold to Megan.

See Notice of Person Ceasing (29C) - YEO WEE SIONG

How?

Yes, Megan is being sold at a cheap price versus its earnings but is this really an investment you want to make? What about the quality of the earnings? What about the integrity of the management?

I hope this long set of second opinion helps and many thanks for your kind wishes again and I too wish you all the best in your investments.

rgds

0 comments:

Post a Comment