My Dearest Moo Moo Cow,

So the Edge Weekly is suggesting that perhaps a 50 million adjustment is required. Let's do some simple calculations.

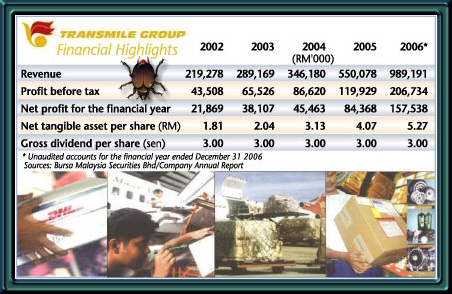

The following table shows TransMile earnings.

So a 50 million adjustment could see fy 2006 earnings adjusted from rm157 mil to rm 100mil.

Now TransMile current number of shares is extremely tricky since it is ever expanding.

The follow screen shot shows TransMile current number of shares today.

So as it is today, there are 270.118 million shares. This means that TransMil eps 'could' be adjusted to a mere 37 sen, IF its earnings is adjusted by rm50 million to rm100 million.

So what PE multiple do you reckon TransMile could command after the adjustment? Do you reckon it could command a pe multiple of 20x after this adjustment?

But if market take the adjustment poorly, TransMile could trade as low as a simple 15x multiple.

20x on an eps of 37 sen = 7.40

15x on an eps of 37 sen = 5.55!

How?

Me?

Honestly, I would rather not guess in such a fashion for I do not really know what is happening but a 50 million adjustment, could do some damage on TransMile in my opinion.

Tuesday, May 15, 2007

50 Million Adjustment for TransMile?

Subscribe to:

Post Comments (Atom)

7 comments:

Dear Moola,

The second picture you posted is really cool. May I know which securities company online trading system is that? My current one really sucks with information fragmented across the website.

CYMAO earnings looks impressive for many years. has been making over 20c each year since it was listed. how do u find its balance sheet & future prospect? they even got their forest concession now... thanks for your advice...

If the 50mil is caused by some sought of permanent damage or permanent problem of income earning, then it would be a big harm for Tranmile, if it is a short term effect, Tranmile will still be looking good in the coming quarter. Just a little opinion.. ^.^

My Dearest Totomaster,

If time permits, I will have a look.

rgds

My Dearest Greenbeast,

That screen shot is from RHB Securities.

rgds

Dear Moola,

I have done some research on GLOBETRONICS TECHNOLOGY BERHAD, and found that the financial background (as analysed the financial statement included cash flow) considered stable and healthy and 2sen earnings per share for years, as all the things remained stable, i am worried about the future growth. The current share price is 32sen and it is going to pay a dividend of 3sen in this month. I can't deny that CYMAO as you analysed earlier is quite a good investment opportunity, and i totally agreed the method you used to analyse a stock, but how do you calculate the stock is actually worth? By P/E? Normally if better future we can accept higher P/E, this is the way i used to measure whether it's under or over valued.

Thanks for your help.

sorry, amended, Globetronic dividend is only 0.03sen.

Post a Comment