The recent downtrend had been noted many times on this blog.

A month ago..

- China Shipping Warns Bleak Outlook For Baltic Dry Index

- Eyes On The Baltic Dry Index Again

- Baltic Dry Index Reverses Yet Again

- Some Comments On The Shipping Sector

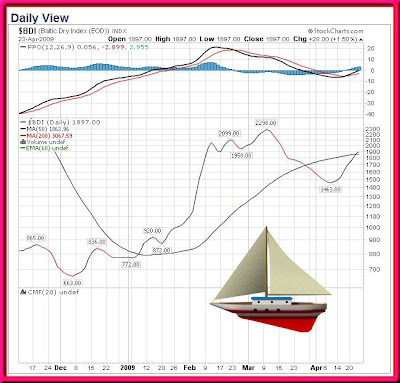

Note the BDI chart posted on the posting

Baltic Dry Index closed last night at 1897.

And according to Bloomberg news article on 20th April, Baltic Dry Index Rises to Highest in Almost a Month on Grains demand in iron ore and grains were the driving factor.

- “Grain is a big driver of the market,” Steve Rodley, a London-based director of shipping hedge fund manager M2M Management Ltd., said by phone today. Some ships are sailing from Southeast Asia to collect the grain cargoes and iron ore is still shipping to China, even as stocks there grow, he added.

*stocks grow or inventory build-up. Do not discount this issue. :p2 *

In another article.

- Dry bulk market back on track

Tuesday, 21 Apr 2009

Hellenic Shipping News reported that market analysts said that what the shipping industry needs at this point is a steady and sustainable rebound of the world economy. At the same time, the huge order book in almost all segments of the market will have to be substantially trimmed. Then one can state that all pieces of the puzzle will be put in place for a new growth cycle to be established in shipping. Until all of the above occur, freight markets will be suffering. Despite that, the week ending today seems to be recuperating some of the losses occurred in the dry bulk market during the past month.

The Baltic Dry Index leaped by another 70 points to reach 1,604 points, with all sectors gaining ground. Once again the panamaxes were the big stars, with the relative index gaining 132 points at 1,413. But, the fragility of the sector is more than obvious, with high volatility being the norm. Nevertheless, average daily charter rates have reached USD 11,331, up by USD 1,066 on a day to day basis.

In its weekly report, Fearnley’s appeared optimistic as to the fortunes of the capsize market, stating that it’s poised to go upwards, with Brazil/China route showing signs of firming, while the same but to a lesser extent is being reported for West Australia and China. Fearnley’s also shed some light behind the rise of the Panamax market, by saying that due to Easter, owners and charterers seemed to cover their requirements before entering holiday, which boosted rates. Also, "South America grain was the driving factor for front haul business, with charterers still taking tonnage from the oversupplied east Indian ocean market."

According to the weekly report from Weberseas, there is good news for the various dry bulk owners looking to buy vessels since, because there is an acceleration of tonnage coming out from Japan. Up to now we have seen many buyers in the market but correspondingly fewer deals being concluded due to the gap in sellers buyers prices. However, as more and more vessels come out in the market the increase in supply should in theory suggest lower prices. Despite that, prices are holding. Buyers are out there to pay levels that many sellers find acceptable even though the freight market does not necessarily support such prices by the poor average returns. (source: here )

1 comments:

R this temporary rise in Baltic Index cause by large number of goods delivered at destination but buyers unable to fulfill the whole contracts due to various reasons being ship back to the country of origin ?

Post a Comment