Got the following comments. ;-)

- Companies make capital expenditure all the time. Care to explain your fuss over the plants and machinery issue?

London Biscuit again?

Seriously I do not understand why the interest but for what's it's worth, let me share my flawed way of thinking on London Biscuit once more.

Yes normally, capital expenditure is required.

But is this the case for London Biscuit?

Let's call the Property, Plant and Equipment issue as PPE.

But why did I state this issue? Yes, why did I highlight this issue?

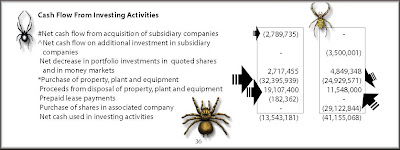

As I was reading London Biscuit's Annual Report 2009, I glanced through the Cash Flow statement.

See the loss of disposal of PPE (Property, Plant and Equipment) in 2009? And in 2008, it made a gain from disposal of PPE.

What does this suggest to me?

This tells me the company is wheeling and dealing in PPE (Property, Plant and Equipment)!!!

And the lower section of the cash flow confirmed my suspicion.

How?

- Purchase of property, plant and equipment 32.395 million vs 24.929 million

- Proceeds from disposal of property, plant and equipment 19.107 million vs 11.548 million

Isn't that a lot?

And here's a new compiled table.

The PPE column indicates the value stated in London Biscuit's balance sheet.

The Buy PPE column indicates total purchase of PPE.

The Sell PPE column indicates total disposal of PPE.

I have no numbers for 2010 because the fy 10 Q4 earnings just shows a summary figure. Have to wait for London Biscuit annual report release in December.

How?

Since fy 2006, London Biscuit purchase and disposal of PPE is rather significant isn't it?

So would it not be wrong for me to declare that it appears that London Biscuit is wheeling and dealing in PPE?

ps: question: the PPE used to indicate what value? How reliable is the PPE when there is significant purchase and disposal of PPE each year?

ps: London Biscuit share is 'now' enlarged to 96.104 million, many thanks to the CRAZY ESOS where 17.969 million new shares were issued. Oh, London Biscuit is saying it's paying 'less' dividend, yes? Is this what they mean by more men means less share?

----------------------------------------------------------

ps: dedicated to Solomon:

pg 53 of London Biscuit's 2009 Annual report. This is what 314.627 million worth of PPE consists of...

10 comments:

To me, it sounds like that it either bought the wrong machine or could it be left hand to right hand sales?

Without proper narration in the account notes, it will only stretch the guessing??

Why not do an audit on the machinery, see whether they are around?? Brown cow, don't stay in the farm and eat grass....eat some biscuit ok?? Maybe, someone is trying to whistleblowing??

Yes, without proper narration in the account notes, whatever was written in this posting, does stretch the guessing to the extreme. :P

How?

ps: Do you know which store carries their stuff? And could I confirm with you because if I am not mistaken I do not recall stores like Giant, Tesco, Carrefour or Jusco carry their products.

solomon: added a screen shot for you. :D

Moola has taken the effort in exposing the wheeling dealing on PPE of London Biscuits. Allow me to present LB's performance in a different perspective. The important metric for performance is return of equity, ROE. Dissecting ROE of LB by Dupont analysis into:

ROE=NI/E=NI/S*S/TA*TA/E

NI is net income, S is sales, E is total equity, TA is total asset. For the last financial year, profit margin, NI/S=8%, Asset turnover S/TA=0.44, and leverage TA/E=2.0, giving ROE=8%*0.44*2=7.1%. ROE is very low despite the high leverage (hence risk). This is because asset turnover is very low (poor usage of assets) and profit margin is low. Profit margin has deteriorated steadily from 14% in 2005 to the present 8%, a huge drop. How well does LB utilizes its invested capital? The return of capital (ROIC) is pathetic at only 5.4%, which I believe it is even lower than the after cost of debt. LB appears to be a good buy for many people because of its seemingly low PER. In what form is the E in the P/E ratio? In the past 6 years, I do not see any positive free cash flow at all in any single year! Dividends have been slashed year after year to 1.5 sen per share. In fact I doubt there is any cash for this dividend payment, if not from more borrowing. Can one see the big problem with LB now? Can anyone still want to argue that LB at 1.07 is a good buy?

One might misunderstand the responsibilities of an external auditor. It’s not a duty for the auditor to detect fraud in a company. The auditor would normally free from any charge or encumbrance unless negligence is proved.

An auditor may suspect something wrong somewhere after reviewing of accounts but it is not sufficient to justify the qualification provided adequate evidence obtained from an audit.

What can an auditor do if the plant and machinery is confirmed physically existence and the purchased VALUE supported with proper documents? Assess the impairment of assets? It’s rather difficult….so many subjective issues if the machines are not idling….

tklaw: Ooooh... don't get me misunderstood.

I am not suggesting anything. Seriously.

All I did was laid out the facts that London Biscuit had been purchasing and disposing PPE a lot.

Yes, I questioned London Biscuit strategy.

That's all.

Moolah, Don't get me wrong. I just wanted to point out the limitation of audit work conducted by the external auditor. Your comments do reflecting the facts and not suggesting any mis.... but some may question why auditor this and that... :)

Moolah, I am not suggesting anything serious too.

I just saw Megan Fox picture lying ahead in the music store, it just bring my memory to once upon a stock called Megan....

I am not questioning the quality of audit work either, knowing who is the pay master for the audit bill?

The real question is if yr core biz is producing confectionary, why on earth u start buy and sell PPE? Then Moolah Biscuit should call Moolah PPE??

tklaw: LOL! I un... but... I am merely protecting my beautiful... asssset. :D

solomon: LOL! LOL! LOL! Megan is sooooo out already. You don't like her 'replacement'? :P

Yup, Moolah I am sooooo out now....too busy in life nannying...I still like the Paraguay WC Milk Lady??

But, anyway thanks for the dedication, I am honoured.

If auditor cannot reveal the true picture, maybe the justice sword the investors now could look forward is a business review by SC....hope not for this case??

Post a Comment