I was listening to some coffee table chat on Kenmark. And naturally since Kenmark shares had collapsed from 90 sen, one aunty was quick to blast the investing strategy. Because of the collapse of the share and the incredible losses announced by the company, she was quick to stress that buy and hold does not work in Malaysia, not when companies like Kenmark are listed.

Is this really the case?

I have compiled a set of data. Now do verify the data because I made the compilation myself and obviously, I could screw up with the data. Hey, I am not perfect. Not at all.

Now assuming one had 'invested' in Kenmark after Kenmark's fiscal 2005 numbers. Now Kenmark reported 2005 Q4 earnings can be found here: Quarterly rpt on consolidated results for the financial period ended 31/12/2005. That earnings was made in Feb 2006.

The next year, Kenmark changed its fiscal year. Hence 2007*** represented a 15 month fiscal year. Yeah kind of complicated.

That earnings was reported on May 2007. Consolidated results for the financial period ended 31/3/2007

If you click on that earnings link above, Kenmark lost 6.618 million for the quarter.

Which means, Kenmark's net profit for 15 months is only a mere 4.545 million or a razor thin 1.25% only. Cash balances only 18 million and loans over 137 million.

The massive drop in profitability was a big, big warning yes?

Now if one had purchased Kenmark, should one continue to HOLD the stock given such a circumstances?

Does one want to hold and hope that the business could recover? What was Kenmark's core business?

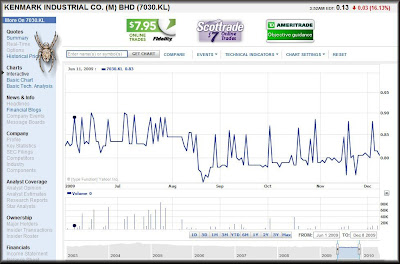

And amazingly, the stock was very kind. Look at the chart above. If one purchased the stock as suggested in Feb 2006, at around maybe 1.08 or so, one could have easily exited the stock with minimal losses.

Now one assume ignored this warning and continued holding to the stock.

The next fiscal year 2008, earnings did improve.

Perhaps HOLDING looked like a smart move.

Come May 2009, all the warning signs flashed like mad. ( see the compiled table)

Earnings dropped back to 4 million. Net margins slumped to 1.6%. Cash slumped to an incredible low 0f 2.222 million. Loans were 144 million and receivables were over 160 million!

Given such razor thins profit margins, were there any logical reasoning that Kenmark was running receivables over 160 million???

Seriously that is sounding like an extremely poor company with very weak fundamentals, yes?

That warning was on May 2009!

And again the stock was very nice to investors seeking to exit for it held strong.

The above chart showed Kenmark's trading range between June to Dec 2009.

Still HOLD on to the stock despite the clear deterioration in the company's fundamentals?

(the following notes taken from what I had posted in the posting A Deeper Look At Kenmark Losses )

Aug 2009: Quarterly rpt on consolidated results for the financial period ended 30/6/2009

2009 Q1

Sales 57.686 million Net Profit 1.013 million Receivables 207.584 Million Cash 2.202 million Total borrowings 144.463 million.

Any improvement? Or did the spike in receivables raised the warning signal up another notch?

Is this not yet another reason to leave the stock?

Nov 2009: Quarterly rpt on consolidated results for the financial period ended 30/9/2009

2009 Q2

Sales 35.334 million Net Profit 3.718 million Receivables 225.317 Million Cash 2.298 million Total borrowings 143.354 million.

By Nov 2009, earnings did improve but receivables have now gone up another notch. It's pure insanity now that receivables are now at 225.317 million. And despite the improve in profits, Kenmark's cash level is still extremely low at 2.298 million!

Seriously... does it make any sense to hold the stock?

Isn't it so clear that Kenmark did not even look like an investment grade stock at all?

And isn't it so clear that EVEN if one had make an investment mistake by purchasing Kenmark stocks, one could easily exited the stock with minimal losses if one had acknowledged the fact that perhaps they had err-ed by investing in Kenmark.

Now Kenmark has collapsed... totally.

Should one fault the investing strategy 'Buy and Hold'?

No I would not.

Kenmark business fundamentals had been poor for so long already. There was no reason to buy the stock, let alone hold the stock!

Sorry but this is my flawed conclusion.

1 comments:

Good post again Moolah. The same thing could be said to BP when the whole oil spill thing happened but no verdict as yet. Let me paraphrase Mr.Soros a little. Buy and hold fails when the practitioner of the strategy doesnt know when he is wrong.

Post a Comment