So what do we have? Kenmark submitted its quarterly earnings, which was clearly an insult to the investing public in the manner they presented the report in which they showed utter no respect to the investing public by NOT disclosing how much was provided in their provision for doubtful debts! Thank goodness the folks at Market Surveillance, Securities Commission realised that this is not right as it was not only misleading AND there was no effort from Kenmark to show how it had suffered so much losses. Hence the stock was suspended yesterday. Now Kenmark did made a reply and because it did the stock will resume trading today.

However, for those who took a look at what was reported must have been shocked at what was submitted to Bursa.

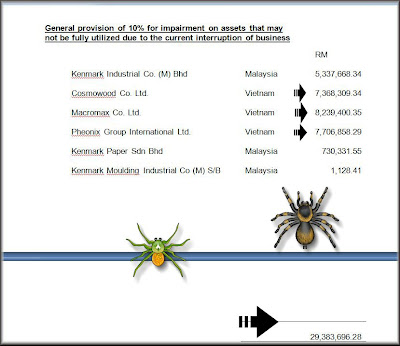

1. Fixed asset - general impairment = 29.383 million.

2. Fixed asset – full impairment as idle asset = 22.439 million.

WOW!

So we have fixed asset general and full impairment causing losses of over 51 million!

Now I am not an accountant or auditor but if I have vested interested in Kenmark, I would definitely would want to see WHY such a huge provision is needed on its fixed asset.

Then we have provision of doubtful debts.

General provision at 100% (exceed 12mths) = 69.206 million!!!

Size of the provision is mind boggling!

Now if you look at point #2

Fixed asset – full impairment as idle asset = 22.439 million.

This is explained by the following..

Yes, from the above, we can see that provision for 'idle assets' consisting of machinery totals a whopping 15 million!

Key word, idle.

And of course, the inquiry mind wants to know the original book value of the machinery and needless to say why the machinery are left idle!

Common business sense, why did Kenmark buy such valuable machinery but only to be left idle!

Regarding point #1.

1. Fixed asset - general impairment = 29.383 million

Assets not fully utilised due to current interruption of business amounts to a whopping 29.3 million.

What's interesting is its assets in Vietnam. The impairment losses totals some 23.2 million and this is only a 10% impairment. Yeah.. go figure the size of its plants in Vietnam. And given the size of the plant, how come Kenmark business the previous years, never show any potential at all? Don't you wonder? I certainly do.

Source: Appendix A.doc

Next we have the doubtful debts issue - the 69.2 million issue!

Now the provision of bad debts comes from 3 companies.

- Kenmark Industrial Co. (M) Bhd

- Billion Dynamic Sdn Bhd

- Kenmark (Labuan) Limited

Kenmark Industrial.

Firstly the screen shot belows shows that it is such a joke how Kenmark conduct its business! Its business aging has columns for over 330 days!!!

Now because the aging has so many columns, I will show only from 180 days onwards..

(the above table is clicakable for a larger view)

(the above table is clicakable for a larger view)Comments.

The above table shows the before and after bad debts provision.

From the formula embedded, Kenmark's amount is only considered due after 180 days. In layman's term, this mean, you can buy a product from Kenmark, the product is only due for payment after 180 days! ( ps. if one is interested in looking at Kenmark from a business investing perspective, one could dig out recent quarterly earnings and look at Kenmark's recent OPERATING PROFIT MARGINS and evaluate if there was any justification for Kenmark to run business in such a manner, ie allow its customers to pay only after 180 days. Why? If the margin is small (ie 10% or less) then common sense would dictate that it's simply suicidal to conduct business in such a manner!)

From the worksheet, it appears that some 25.182 million was written off as bad debts from Kenmark Industrial Co. (M) Sdn Bhd. (you can get this figure by subtracting 20.379 million from 45.562 million.)

Note the 3 'big' companies benefiting from the provision of bad debts: BILLION CREATOR (HK) LTD and DAILY EMPIRE TRADING LIMITED and EVER VICTORY (HK) LTD.

Now if I suspect something is amiss or if I suspect any hanky panky, I would dig up more info in these 3 companies. Yeah, check if there is 'freindly' relationship between these 2 companies and Kenmark.

Oh yeah, the amount due which is over 330 days totals 24.641 million!!!

Next we have Billion Dynamic Sdn Bhd.

Hmmm... Billion Dynamic Sdn Bhd and Billion Creator (HK) Ltd ..... hmmmm.... first name... same!

Very straight forward!! (the above table is clickable for a larger view)

Billion Creator (HK) Ltd owes Billion Dynamic Sdn Bhd 44.565 million. This amount is over 330 days.

Wiped clean!!

!!!!

No more debts owing from Billion Creator to Billion Dynamic!!!

Simply. Easy peasy!

Lastly, we have Kenmark (Labuan) Limited.

(the above table is clickable for a larger view)

Not much provision was made but note the 3 companies again. BILLION CREATOR (HK) LTD and DAILY EMPIRE TRADING LIMITED and EVER VICTORY (HK) LTD.

The bulk of Kenmark's debts comes from these 3 companies.

And it seems that Billion Creator (HK) is the luckiest company in this saga. Owed Kenmark and subsidiaries so mcuh money, now most wiped clean. No need to pay!

Good or what?

Source: Debtor Aging.xls

So how?

Do you like what you see?

One big question for me...

ok, one can just slam Kenmark for being a bad business for allowing its customers (or 3 companies - Billion Creator, Daily Empire Trading and Ever Victory) to run up such massive debts on a relatively insane credit terms of over 180 days but what I want to know is why now?

Yes, why now.

Take their quarterly announcement reported last year. (I will paste what I had posted previously)

May 2009: Quarterly rpt on consolidated results for the financial period ended 31/3/2009

2008 Q4

Sales 38.775 million Net LOSS 0.084 million Receivables 163.773 Million Cash 2.222 million Total borrowings 144.574 million.

Yes, receivables last year was already an insane 163.773 million.

Now what I want to know is, from this 163.773 million, how many of the debts were over 180 days? Were there any debts over 330 days back then?

Sorry but surely the inquisitive mind would want to know, yes?

And how long ago has Brilliant Creator being a customer of Kenmark?

These are the simple questions that needs to be answered.

And yes, the ownership in these 3 companies. Are they 'friendly' to Kenmark boss? How close is the friendship?

Last but not least...

We all know Kenmark boss was said to be sick or unconsicous or maybe kidnapped. (Sorry, I simply do not know what to believe, hor)....

From Bursa website: http://announcements.bursamalaysia.com/EDMS/edmsweb.nsf/LsvAllByID/20BC43B4778D69064825773C003C329F?OpenDocument

- Further to our announcement dated 3 June 2010, the Directors wish to inform that based on the Record of Depositors dated 7 June 2010, the shareholding of Mr Hwang Ding Kuo @ James Hwang is 14,193,792 Kenmark shares or approximately 7.96%.Mr James Hwang on 23 April 2010 notified that he has 53,363,092 Kenmark shares (29.93%).This announcement is dated 8 June 2010.

Yeah, finally when queried, Kenmark finally disclosed the above information!

I wonder if no query, when would Kenmark disclose?

From owning 29.93% on 23 April 2010, James Hwang shareholding suddenly shrank to a mere 7.9%

Go figure!

Yes, the boss has been dumping his shares like mad!!!!

What's MOST UTTERLY DISGUSTIBATING is....

1. No disclosure on when his shares were sold.

2. No disclosure on the price transacted.

Surely this is not acceptable!!!!!!

( see also: Theory On Kenmark's Soaring Trade Receivables And Massive Provision Of Bad Debts )

0 comments:

Post a Comment