They keep telling the market the stock is good and the stock should be worth some 1.60.

But the stock is trading at 70.5 sen only.

Is this the big one? Is this the big 'value' stock to bet on?

Ah.. I am talking about Perisai, a stock blogged several times before

- 31 Mar 2011: Perisai: Life Is Too Damn Good!

- 31 Mar 2011: RHB Clarifies Its Statement On Perisai

- 31 Mar 2011: Perisai Asked To Explain In Details Its Purchase Of Garuda Energy

- 1 Apr 2011: Perisai's Reply To Bursa Query

- 1 Apr 2011: A Little Chat With Dali On Perisai

- 2 Apr 2011: Featured Post: Legg Mason Sold Every Single Share Of Perisai They Had Bought On 23 Mar 2011

- 3 Apr 2011: More On Perisai

- 4 Apr 2011: Why Perisai Is Rated So High By The Local Analysts?

- 5 Apr 2011: More Interesting Statement On Perisai

And here's the performance of Perisai since Mar 2011. ( Arrow indicates 31 Mar 2011 )

So they (CIMB Research) have been telling the market that Perisai is worth 1.60.

Does this price of 1.60 gets anchored into you??

Think about it.

When you look at Perisai the stock, does it becomes automatic for you that Perisai should be worth 1.60?

But... but .... butttttttttttttttt........ what about the reasoning behind the buy call?

What about how CIMB got the Target Price of 1.60?

Think about it...

On 23 June 2011, CIMB released the following report.

Target price raised to 1.60.

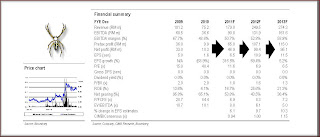

The numbers ...........

See the numbers???

Perisai had 10.3 million profit in fy 2010.

Perisai's earnings is then PROJECTED to grow to 46.9 Million in FY 2011, 90.4 Million in fy 2012 and 95.1 Million in fy 2013.

See the massive growth projected for Perisai?

Remember the hefty Target Price of 1.60 is based on the ability of Perisai to deliver such earnings.

Perisai reported its earnings last night. It made some 7.843 million, which represented an increase of 26% when compared against the fy 2010 numbers.

Of course it look impressive...

But.... but.... butttttttttttt...... as impressive as it is.... its current half year fy 2011 net earnings is only some 15.063 million.

Half year net earnings is only 15.063 million??!!!

And CIMB profjection for Perisai's fy 2011 is ................ 46.9 million!

Errr... how?

Isn't Perisai performing well below CIMB's expectation?

Or is CIMB's expectations of Perisai's earnings simply wild?

Well? Take your poison.

And for the record, here's Perisai most recent 4 quarters or trailing twelve months earnings.

How?

Do you think Perisai even make 95.3 million profit projected by CIMB come fy 2013???

Oh as it is... you can see the current half year EPS for Perisai is only some 2.23 sen.

Yes current half year EPS is only 2.23 sen.

And Perisai last traded at 70.5 sen.

But don't you worry, according to CIMB numbers game, they say Perisai is worth some 1.60.

4 comments:

Reading CIMB reports need to tune ourselves in reverse logic, meaning that as the price of the counters moved up as CIMB seems to have a lot of followers, you can bet the privileged few will be throwing out shares to the unsuspecting but hopeful small fries. The end result will always be the public got trapped with shares bought at the highest level.

Besides Perisai, remember JCY, Muhibah and others? Is the public so gullible?

Very true... but .... do you notice that when the market is hot.... all that matters is the STOCK and its TP?

The reasoning and how the TP derived matters ...... NOT.

And after time ..... most is forgotten.

So the earnings came in 32% of their (CIMB) full year forecast...

but... no worry.... CIMB calls it broadly in-line.

>>>

Broadly in line. Perisai continued to reap the benefits of last year’s successful restructuring. Though 1H net profit accounted for only 32% of our full-year forecast and 31% of consensus estimates, we consider it to be broadly in line and we maintain our EPS numbers as we anticipate a stronger 2H when maiden contributions from Intan and Garuda come through. These two acquisitions support our 3-year EPS CAGR of 95% and give Perisai the most share price upside in our oil & gas portfolio. Despite this, FY12-13x P/Es are under 7x, making Perisai the cheapest stock in the portfolio. Our target price remains at RM1.60 as we maintain our valuation basis of 14.5x CY12 P/E based on our target for the market. Potential fleet expansion and marginal field ventures underpin our OUTPERFORM call.

Moolah,

If we could only short certain stocks like these.... sigh! Is short selling allowed in Malaysia or will it be allowed in the future?

Your blog would provide more than ample targets :D

Post a Comment