So JCY announced its earnings and it was really poor.

Remember the posting Is RHB's Downgrade Of JCY And Fair Value Call Of Only 22 sen Too Harsh?

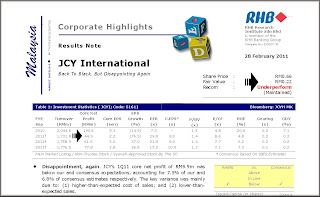

Let me produce the screen shot again:

RHB, back in Feb 2011, felt that JCY should be downgraded to 22 sen based on the earnings estimate of 44.9 million.

And yes based on its share base of 2,044,860,000 shares an earnings estimate of 44.9 million would translate to an eps of 2.2 sen only.

I know RHB then made a FUNKY Change Its Fair Value On JCY! shortly after that incredible downgrade!

Anyway, I find it so ironic now.

RHB downgrade on Feb 2011 was shocking. It was the only research house that said JCY could earn as low as 44.9 million for this fiscal year.

Now let's compare to what JCY is doing..

TTM stands for trailing twelve months earnings and JCY's TTM says that JCY is losing some 34.443 million!

Which means..... JCY is very unlikely to even earn 44.9 million this fiscal year!

Think about it....

RHB said that if JCY could earn some 44.9 million, JCY should be valued as low as 22 sen.

Now? JCY it's very likely that JCY could not earn 10 million this fiscal year!!!

Yeah... and so how much do you reckon that JCY should be worth???

22 sen?

Or lower?

Some other comments.

1. What a shame! Such a performance from a billion dollar company. And this billion dollar company was listed only on Feb 2010. Yet another quality listing on Bursa Malaysia eh?

2. From the first posting on JCY: Regarding JCY International : "JCY earned some 207 million for its fy 2009. CIMB says times are good in 2010, so JCY should earn some 359 million! And 2011, JCY earnings will be even more super. JCY should earn some 441 million by then!" -- Yes! CIMB had predicted that JCY could earn some 441 million for this fiscal year! .. currently JCY's TTM is a loss of 34.4 million!! How's this for being way off?

3. Same posting: Regarding JCY International.

peng01 said:

- How much money do JCY raise in their IPO ?

The total amount due to shareholder is 173mil, and they hav settle it in 9 months.

Total loan 360mil, where 280mil is short term loan.

But still able to give 80mil as dividen and buy equipment for 200mil last quater.

Otak boss JCY rosak ke ?

............ you should wrote this article when jcy hit the high of 1.90, 阿弥陀佛。

So, IPO rm750mil, all masuk pocket YKY investment,

And jcy shareholder get rm80mil dividen angpow only, and this 80mil angpow paid is borrow from bank.

Putting this issue into current perspective.... how?

My reply back then.

Well, JCY had 'hoped' to raise some USD 350 million from its IPO.

See : So Many Cash Calls In Our Market

But JCY was not lucky. :P

It had to scaled back its IPO. ( I wonder why. :P )

JCY only managed to raise some 750 million.

JCY to slash IPO size on weak pricing

And to put your issue in an even better perspective, do refer this news clip JCY set to be Southeast Asia’s largest tech IPO

Quote: "Interestingly, the IPO is expected to give a payout to major shareholder YKY Investment Ltd up to RM1.25bil based on the maximum retail price of RM2.00 per share, assuming it is at 5% discount to the placement price and the full over-allotment option is exercised.

The question floating around is: Why is the IPO an ‘offer for sale’ by 74.1% sole shareholder YKY Investments Ltd?"

Ahem!

And yeah... to make it more 'interesting'

For fy ending 30 Sep 2008, amount owing to shareholder is only 5.8 million. The following year, this amount balloons to 173.20 million! ( see page 75 of the JCY's pdf attachment posted on Bursa Malaysia. )

0 comments:

Post a Comment