- And i would like to share with you my finding on elsoft. I know u dont like MESSdaq but it looks appealing to me. The best thing is no research house ever notice it yet. PLs comment.

There's not a whole lot of info I have on Elsoft and yes i dun see any research report on it. The best I can gather is via their website

- Elsoft is principally involved in research, design and development of test and burn-in systems and application specific embedded systems. Elsoft mainly provides cost effective ATE solutions to the semiconductor, optoelectronic and automation industries. The Group’s key product i.e. test and burn-in systems are used by its customers who manufacture optoelectronic devices such as LED, image sensors and automotive lightings to test their products before launching into the market. The name “Elsoft” consists of two elements i.e. Electronics and Software, symbolising the Group’s core competency in advanced electronics design and software technology innovation.

And here is some company historical background and here is what they do.

- Elsoft offers the industry’s most comprehensive portfolio of design, validation and production test solutions from a single ATE supplier. Utilizing our unique Source and Measurement Unit (SMU) solutions, we enable customers to customize test flows that significantly reduce their design-to-volume-production test time and costs, while improving overall performance, quality and functionality. As a test and burn-in solution provider, in-house developers of the Group can improve an existing test system or design new test solutions to meet a specified test strategy required by its customers. The switching trend of the industry’s evolution from high cost test and burn-in solutions towards cost effective test and burn-in solutions has bridged the Group to the stage of the global ATE arena. Elsoft offers its customers a new paradigm of alternative test solutions which aims to provide high performance and cost effective application solutions.

Elsoft was listed on 27th July 2005 and it would appear that Elsoft is generous with their dividends. In the short time they are listed, Elsoft had already rewarded their shareholders with two set of dividends. (Interim Dividend and Second interim dividend) (Dude.. it's not too bad, huh?)

Here is a snapshot from osk/klsetracker.com on Elsoft quarterly earnings.

And again I have to say it is pretty impressive. It appears it has growth and the margins are really solid.

And this is what Elsoft has to say in their research report posted on Bursa website.

- Turnover and profit before taxation

Elsoft Research was listed on the Mesdaq Market of Bursa Securities on 2 August 2005. Hence, no comparative number was available for the preceding year corresponding quarter.

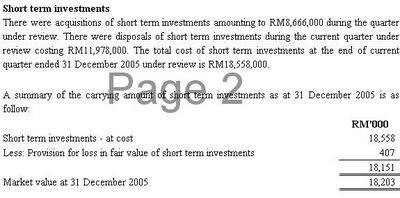

For the fourth quarter ended 31 December 2005, the Group achieved a turnover of RM8.119 million. Compared to the RM10.968 million achieved in the third quarter ended 30 September 2005, turnover was 26% lower. In spite of lower revenue recorded mainly due to lower contribution from the Group’s subsidiaries, the Group’s fourth quarter profit before taxation rose 20% to RM5.662 million from RM4.734 million achieved in the preceding quarter. The growth in profit before taxation was mainly attributable to higher distribution from short-term investments, the writing back of overprovision for bonus and higher contribution from significant increase in repeat orders of test-systems that boosted profit margin.

For the twelve months ended 31 December 2005, the Group recorded turnover and profit before taxation of RM33.307 million and RM17.032 million, respectively. The group’s effective tax rate of 1% for the period under review was lower than the statutory rate due to Elsoft’s pioneer status.

Prospects

Management is optimistic about the Group’s performance for the financial year ending 31 December 2006. The Group foresees LED test instrument growth to be driven by ramp-up in the use of High-Brightness LEDs in mobile appliances, automotive lighting, signals, signs and displays, illumination and electronic equipment.

The newly developed test system catering for the Display/Intelligent Display market should contribute positively to the Group's financial performance.

In addition, management is expected to streamline the Group’s operations to minimise duplication of tasks to save costs. The Group is putting more effort in the development of electronics instrument for the test and measurement market.

(Did you see the reason for the growth? - The growth in profit before taxation was mainly attributable to higher distribution from short-term investments, the writing back of overprovision for bonus and higher contribution from significant increase in repeat orders of test-systems that boosted profit margin. )

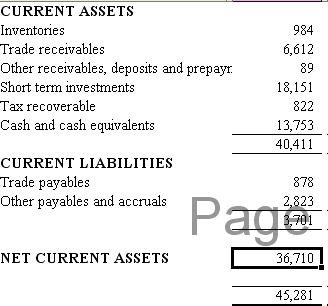

Here is a snapshot of its balance sheet.

Clean net cash... no debts... except the worry is the size of its short term investments..

If we look under notes b7.. this is what it states...

It's cash flows is ok..but we really cannot conclude anything much from it... too early days yet.

I have to admit that Elsofts operating profits are pretty darn impressive...

And here is how Elsoft did since listing...

how dude?

I guess i can understand why you have said that it looks appealing for you.. ur only worries are.. lack of demand of the stock (ahh... me sure u know how deep this issue is.. :p), the size of its short term investments and it's still too new to past any real judgement on it...

cheers dude!

3 comments:

nm,

Yap, the problem with elsoft is well noted. I treat this as a red-flag which i would monitor carefully. For me, as long as they dont do a lot of debt, some short term investment wont hurt that much as over expansion...... But it's a red flag.

The key attractiveness of elsfot is its under coverage. This also explain why the lack of trading enthusiasm in it. Its vol is meagre but its trend after listing is undeniable one way, up.

Another problem with this penang based company is their management is pretty media shy. I wonder how their PR section will response if we call them and enquire company information? Anyone tried this before?

Dude,

did u could surf their website? I think u could drop them a line or two... :)

cheers!

It is a technology based company. Its product technology barrier is high. Hence, it may enjoy a high profit margin, due to lack of competitors.

There is another penang based technolgy company named ViTrox, which share the same characteristic as ElSoft. Lack of competitors... high profit margin... Yup. cause, also lack of trading enthusiasm in it

Post a Comment