Date: June 28th 2003.

The Star Biz published a news article on this company called AE Multi.

The above is the news clip. Do note what was stated in red (see below).

- AEM recorded revenue of RM68.7mil last year. Its profit after taxation was RM7mil, exceeding its forecast of RM6.9mil or an improvement of 1.4%.

The period concerned is highlighted in yellow.

Here are some very interesting stuff for me... :D

1. When a company has a news write-up on it and somehow the article only mention the previous quarter, one better be cautious. Why is the company focusing on OLD news? Doesn't it makes sense to find out why?

In AEM's case.

- Sales 13.105 mil vs 18.319 mil (q-q)

Net profit 0.383 mil vs 1.683 mil (q-q)

These facts were announced on 26th May 2003. Star article came out June 28th 2003. The Net profit dropped so much, but yet the company decided NOT to mention this in their press conference and instead only talked about the previous quarter earnings.

How? Don't you find it STRANGE that AE Multi decided to use the previous quarter earnings? Earnings which showed AE Multi made 1.63 million. Why didn't AEM use it's current earnings of a mere 0.383 million as reference?

Why?

2. Profit after Tax (PAT) does not necessary equate to net earnings. Taxes do need to be paid, right? And in the case of a newly listed companies, one has got to be very prudent since the earnings could include profits derived from the IPO listing exercise of the company.

In AEM case, pre-acquisition profit totalled 1.486 million. If you minus this out from the earnings announced, AEM actually did much worse than its previous year.

So perhaps one should ask if this was a slip-up by the company or was the company trying to dress up and glorify its earnings?

Here is the company statement again:

- AEM recorded revenue of RM68.7mil last year. Its profit after taxation was RM7mil, exceeding its forecast of RM6.9mil or an improvement of 1.4%.

3. Whenever there is a drastic fall in the earnings, shouldn't an investor be worried?

Or shall one say that ze red flags should be raised, and one should be on the very alert to call it quits on a company whose business fundamentals are deteriorating drastically.

Look at the table again. By fy 03 q2 earnings release on 28th Aug 2003, one should have made up their minds to EXIT. This was a bad stock selection, time to move on.

What would have been the exit price?

Now it is very interesting to note that the day after it announced the second consecutive rotten results, AEM moved UP higher by 5 sen.

Logical? Investors/FundsManagers loving such rotten result, that they decided to push the stock up? Logical? and the stock continued moving higher to about 1.78, a couple of days later. Fishy and Smelly? or Smelly and Fishy?

The logical question one should ask is what if they knew that the company result is poor and that the future is bleak?

Doesn't it then make sense for them to push it up higher, so that they can sellout their holdings?

Well, all said, one should have exited this bugger in the 1.70 range...

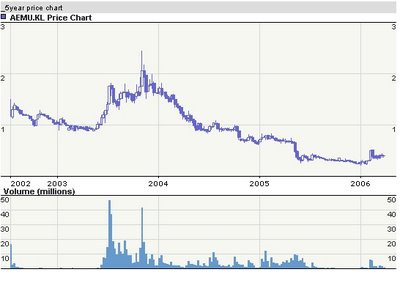

(of course it would probably looked REALLY BAD ADVICE cos AEM peaked at 2.44 a couple of months later!!.... LOL!!!!...... yup... yup.... see the chart below..... but do wait.... and see the end result today!)

4. That tracking of shareholding issue. See compilation made here: AE Multi. Look at all those transactions.

I see nothing but disposal of shares.

Now again a simple reasoning should be made.

If them majority shareholders do not want their shares then why should you want to buy or even hold such a share?

Surely these majority shareholders know something much more of the company than you because just look at what they are doing.

Selling, selling and selling.... non stop SELLING!!

Isn't this the most decisive reason for one to sell and not even buy this stock?

Ah... for fy 2003 q3, the earnings turned around a lot. Net profit increased from 0.477 mil to 1.371 million. Fantastic improvement. This was announced by the company on 18th Nov 2003. Such a turnaround, did the majority shareholders/oweners vote with their money? Did they take the opportunity to buy more shares backed by such strong recovery in the company's earnings?

Sadly no... the company directors instead sold more shares in Dec 2003! Again what does this suggest to you? Doesn't it suggests that these buggers knew that perhaps the turnaround was not sustainable and that the company future ain't so good? Simple reasonings... no?

5. In our local market, the investing technique of Follow You, Follow Me is not a safe idea at all.

In AEM example, look who is one of star name owners.

If one invest in this stock just because of him, look at the end result.

AE Multi announced a NET LOSS of 13.024 million for its fiscal year 2004. (See how valid the arguement that when them insiders repeatedly SELL the stock as if there was no tomorrow, then it is quite likely that they know that something is wrong?)

AE Multi unaudited NET LOSS for fy 2005 was at 4.189 million.

So how much is AE Multi trading now? Well, yesterday it closed at 0.415. (now that 1.70 selling price... it's looking not too shabby eh?) (ps AE Multi traded lowest traded price was at 0.22!!)

ps.. AEM was offered at a price of 0.80 to the public and it was listed on 15th July 2002.

Now credit to Surf 88. This is what they posted one week after the AEM listing. They give it a big fat SELL rating on it!!!

- AE Multi – Bucking trend?**

By: Surf88

Date: Tuesday, July 23, 2002

Time: 8:28:02 AM

Largest shareholder, Dato’ Azman Yahya, reduces stake from 20% to 18%

Fundamental valuation expensive against regional peers and in view of industry dynamics and challenges

Reiterate SELL as 13.4x Jun 2003 PER is unlikely to be sustained

What sets it apart? AE Multi (RM1.17, stock code 7146) was a refreshing change from recent IPOs. Against our fair value of 91 sen per share and its IPO price of 80 sen per share, the stock opened at RM1.17 per share on its debut day of 15 July before hitting a high of RM1.50 per share. That marked the peak for the stock, which has been sliding since, as shown below :

(RM) Closing price

15 Jul 1.36

16 Jul 1.33

17 Jul 1.28

18 Jul 1.26

19 Jul 1.19

22 Jul 1.17

Is it time to buy? We think not and besides fundamental valuation, the latest development as reported last night also lends support to our view. At the time of listing, we mentioned that two factors may buoy share price to above fair value. First, its affordability at the RM1 region, and second, the sentiment boost stemming from the reputation of its non-executive chairman and largest shareholder, Dato’ Azman Yahya.

Dato’ Azman Yahya reducing stake. Based on latest filings to the KLSE, Dato’ Azman Yahya has sold 1.6M shares or a 2% stake in AE Multi at RM1.25 on 17 Jul. This reduces his stake from 20% to 18%. While he is still the largest shareholder with a substantial stake, that he chooses to sell at the RM1.25 level may be seen as an indication of his expectations relative to stock fundamentals and the current environment. We believe minority shareholders should also take the cue from here, especially considering industry dynamics and valuation.

PCB player with concentrated customer base. To recap, AE Multi is mainly involved in the production of PCBs (printed circuit boards). The company has a concentrated customer base with its top five customers accounting for nearly half of group sales. While track record has been reasonable, AE Multi does not seem to have a particularly strong competitive edge in the industry while there seems to be more challenges ahead. Firstly, PCB is increasingly commodity in nature which points to rising price pressures. Secondly, the emergence of low cost and technology-advanced competitors in China is another concern.

AE Multi at 13.4x 2003 PER. Overall, we expect AE Multi to achieve its prospectus forecast of 18% pretax growth on improved contribution from its Thai plant (its only overseas plant at one quarter the size of the Malaysian plant) in 2002. Going forward, growth is expected to moderate in the absence of new expansion. EPS wise, due to enlarged capital following the listing, we forecast 11% growth in 2002, before a 5% decline in 2003. At the current price of RM1.17, AE Multi is trading at 12.9x 2002 PER, rising to 13.4x in 2003.

Industry giant at 8.4x Jun 2003 PER. In our IPO note on AE Multi, we benchmark AE Multi to Singapore-listed PCB industry giant Elec & Eltek in view of the lack of meaningful domestic comparisons. Due to the global stockmarket decline, Elec & Eltek’s share price has fallen 7% since then and its PER as a result fell to 8.4x for the financial year ending Jun 2003. Considering that Elec & Eltek is almost 20x the size of AE, it seems difficult to justify and sustain AE Multi’s PER at 13.4x 2003 earnings. At RM1.17, the net dividend yield of 2.1% for AE Multi is also not particularly attractive.

Reiterate SELL. In all, the latest developments serve to reinforce our SELL call on AE Multi. In this case, disposal by the major shareholder may well be a telling sign. SELL.

0 comments:

Post a Comment