The wonders of the press!

Flashback. Aug 19th 2003.

There was this nice little article written on the Edge: Rohas-Euco starts second stage of water project

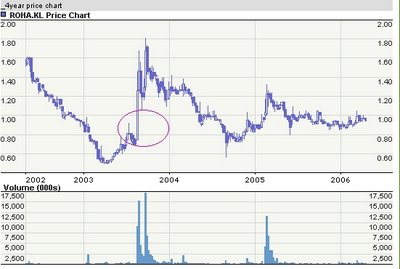

Now the picture below depcits what happened. The circle dentoes the time of the article. See how the stock went zoom, zooming after the article was written?

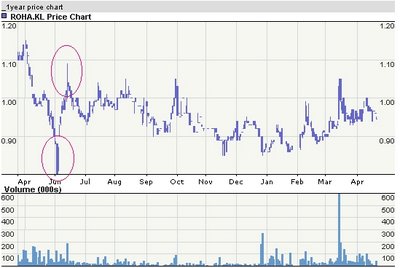

And the following picture also...

Which only prompted the stock getting ze UMA (UNUSUAL MARKET ACTIVITY) thingy!

- We draw your attention to the sharp increase in price in your Company's shares today.In accordance with paragraph 9.11 of the Exchange's Corporate Disclosure Policy on Response To Unusual Market Activity, you are requested to furnish the Exchange with an announcement for public release after a due enquiry seeking the cause of the unusual market activity in the Company's securities. When considering your response and when making the required announcement, your attention is particularly drawn to the continuing disclosure requirements set out in Chapter 9 of the KLSE's Listing Requirements.

Now what was interesting was the following comments...

- However, there was an article published by The Edge Online on 20th August 2003 titled "Rohas-Euco starts second stage of water project" whereby the content of which is confirmed correct and that the transactions mentioned therein have been disclosed or announced earlier save and except for some clarifications as follows:

(i) the Sungai Selangor Phase 3 (SSP3) project involved the design, engineering, procurement, construction, installation, testing and commissioning of mechanical and electrical works and associated civil works as well as the operations and maintenance as was disclosed and announced earlier on 7th December 2000 and not project management as stated in the article mentioned above,

(ii) as previously announced on 15th August 2003, the formation of the joint-venture with Downer Engineering (M) Sdn. Bhd. ("Downer") is pending finalisation of the terms and conditions of the joint-venture and the execution of the joint-venture agreement by the Parties. It was incorrectly stated in the article that REI has formed a joint-venture with Downer last week.

Save as disclosed herein, the Company is not aware of any rumour or report which contains information which might likely to have an effect on the trading of the Company's securities.

See how nicely the stock profited from the error made in the news article?

And here are some more interesting stuff...

Rohas-Euco was not performing that well... as can be seen in the following two earnings report...

- 28/05/2003 Quarterly rpt 31/3/2003

14/08/2003 Quarterly rpt 30/6/2003

So in Aug 2003, the Edge comes out with that write-up....

And viola.... here comes the improvement in earnings...

19/11/2003 Quarterly rpt 30/9/2003

However, if one opens the earnings notes, one would notice the following...

Rohas-Euco's turnaround in fortunes was due to profit recognition..... !

- The Company's and Group's revenue for the current quarter have increased by 86% and 151% respectively compared to the preceding quarter. The increase in Company's revenue was mainly attributed to additional orders received for tower supply and the increase in the Group's revenue was mainly attributed to the profit recognition from the water treatment project carried out at Bukit Badong upon completion of Stage 1 works during the quarter.

And needless to say, a couple of quarters later, Rohas loses money again...

4/08/2004 Quarterly rpt 30/6/2004

Company lost 1.356 million for the quarter, and amazingly, if one opens the earnings notes in the above link, one would find this comment, which gives one the impression as if nothing (no losses) had happened....

- During the current quarter under review, the Group recognised a revenue of RM39 million, mainly attributed to the sales of steel lattice tower structures and the revenue recognition from the water treatment plant project carried out at Bukit Badong.

A couple of months later, in Feb 2005, Rohas reported the following earnings.

28/02/2005 Quarterly rpt 31/12/2004

Rohas current quarter showed an incredible good showing!!!! A net profit of 6.870 million was recorded by the company. (WOW... dat's an eps of roughly 10 sen for da quarter!)

And again, if one reads the companies notes, one would find the company's explaination of what is happening is kinda lacking.!

- During the current quarter under review, the Group recognised a revenue of RM52 million, mainly attributed to the sales of steel lattice tower structures and the revenue recognition from the water treatment plant project carried out at Bukit Badong.

Now, despite the good earnings, one gets a mix reaction from them insiders... cos they were selling!

- 22/02/2005 NOTIFICATION PURSUANT TO PARAGRAPH 14.08 OF THE BURSA MALAYSIA SECURITIES BERHAD LISTING REQUIREMENTS ON DEALING IN SECURITIES DURING THE CLOSED PERIOD.

22/02/2005 NOTIFICATION PURSUANT TO PARAGRAPH 14.08 OF THE BURSA MALAYSIA SECURITIES BERHAD LISTING REQUIREMENTS ON DEALING IN SECURITIES DURING THE CLOSED PERIOD.

21/02/2005 NOTIFICATION PURSUANT TO PARAGRAPH 14.08 OF THE BURSA MALAYSIA SECURITIES BERHAD LISTING REQUIREMENTS ON DEALING IN SECURITIES DURING THE CLOSED PERIOD.

Company announced huge jump in earnings... but them insiders were selling... makes one wonder what is happening, doesn't it?

Well.. the answer was kinda answered on May 2005 when Rohas reported its next Quarterly earnings.

Rohas managed only a net profit of 1.512 million, which was down significantly from the net profit of its questionable 6.87 million announced on Feb 2005. Ahem! Isn't it a wonder why them insiders were disposing their shares?

Anyway on June 14th 2005, there was another article written on the Edge: Rohas-Euco to boost exports

- Rohas-Euco Industries Bhd, a giant local provider of transmission tower steel lattice structures and telecommunication industry, targets to boost its contribution from exports to 60% this year from 50%.

Hmmm... another optimistic write-up on Rohas....

And the picture below shows the market reaction to the news... the lower circle indicating when the stock was written ... and the upper circle showed how high the stock went zoom, zooming....

how nice, eh?

perhaps I should forward my portfolio to our daily financial news... :p

6 comments:

hi moola been following your blog. Am new to investing and would like to follow the fundamentalist route. Would you mind sharing with me how to determine the value of a share by projecting earnings/cashflow and then discounting it? Are there any other methods?

Hello,

Just for ur info, I would like to let you know that I am no sifu and I am NOT qualified to give any investment advice. Me just a mumbler, ok?

Anyhow in regarding to your question, here is some of my opinion...

To determine the value of a share by projecting earnings/cashflow and then discounting it... involves so many variables or should i say assumptions.

To able to project earnings/cashflow is rather difficult because one needs to be able to project the earnings in a fairly accurate manner. Sometimes it is not the issue of the investor's ability to make such projections but the issue lies with the fact that the company's earnings itself is unpredictable and it worsen if the company earnings is very cyclical.

And the time frame is also important. Is one projecting based on a 5-year time period or a 10-year time period.

And when we discount it... what is the discount rate?

IF one is in a highly volatile environment in which the rates are constantly changing, the discounted value will be distorted if one assumes a wrong discount rate.

And lastly... is the company itself competitive enough to see it last the next 5 or 10 years? What if there is a drastic change in fortune?

Moola

hi moola

thanks so much for ur response.

I'm v new to investing and am a layman. Much of what you have opined i understand but the main issue for me is still the very basic first.

1. Can i use the historical growth rate for projections? that is about the only rate that i can think of.

2. discount rate..... i am at a total lost of where to pluck this figure from. I know u are telling me that its difficult given all the things u mentioned, but in the first place, where to get this figure? is it the ROE of the company that i can use as the discount rate? that's the only rate i can think of.

I sincerely appreciate your kind opinion towards my concerns.

Thanks.

hi,

1. Can i use the historical growth rate for projections? that is about the only rate that i can think of.

==> i think it is best that perhaps you google the phrase 'Discounted Cash flow'... u can get tons and tons of hits on this phrase... which should help give you a clear and precise definitiion.

the historical growth used in projecting, say a 10 year cash flow... requires a huge assumption.. which is the company is able to maintain such growth rate. And as everyone knows, growth is finite and if a company is currently enjoying a current growth rate about 20%, to assume that it will continue growing the next 10 years at the same growth rate, is rather risky since commonsense will tell us it is quite no so possible given the fact that growth is finite.

2. discount rate..... i am at a total lost of where to pluck this figure from. I know u are telling me that its difficult given all the things u mentioned, but in the first place, where to get this figure? is it the ROE of the company that i can use as the discount rate

==> the discount rate usually used is the current interest rate or money rate. And as u know, in a volatile economic environment, this money rate could change drastically. A mere change in one whole percentage (1%) discounted over 10 years would change the discounted value tremendously...

Moola

hi moola,

thanks, u were a great help to my "challenges"....

Ur blog is great. I get lotsa investment tips and views and see how to look more deeply and think differently, N not to mention, not to be so naive.

Thanks. Will continue looking for "DCF". Thanks for ur comments.

hi,

it's no problem... anyway...

try this article..

http://www.wallstraits.com/main/viewarticle.php?id=1144

see this part...

==>>

There are several problems with this sort of intrinsic value calculation, which might be summarized as follows:

.Investor must consider cash flows versus net earnings, especially for rapidly growing businesses.

.Investor must estimate current year net cash flows considering capital spending profile.

.Investor must estimate the most probably average annual growth rate sustainable ten years into the future.

==> ahh... this is the most difficult part i reckon... a wrong growth rate.. could easily inflate the 'value' of the stock beyond recognition...

.Investor must estimate the risk-free rate of return over the next ten years, and consider the concepts of 'risk premiums' and 'terminal value'.

.Investor must avoid associating 'intrinsic value' (DCF) with a 'price target'.

Post a Comment