So I featured RHB dramatic reversal in recommendation for Notion Vtec in the posting: Is The Downgrade From RHB On Notion Vtec Fair?

Now get a load of this.

In the posting Some Comments On Notion Vtec, I remarked that ECM Libra made the following posting ECM Libra ups target price for Notion Vtec

Now this same posting can be seen on the Edge Financial Daily. ECM Libra ups target price for Notion Vtec

- ECM Libra ups target price for Notion Vtec

Written by Financial Daily

Tuesday, 27 July 2010 10:41

Notion Vtec Bhd

(July 26, RM2.65)

Maintain buy at RM2.74 with higher target price of RM3.74 (from RM3.63): We hosted a corporate luncheon recently for Notion VTec which was attended by a good crowd of buy-side analysts and fund managers. Management gave some good insights and outlook for the HDD business which will be the main growth driver in the coming years.

We understand from management that due to pricing issues, debt financing will be used instead. Nonetheless, the 1-for-5 free warrants exercise will proceed as planned.

Management believes the 2.5-inch HDD segment is where growth is due to (i) the explosive growth of data, (ii) high growth of external HDDs and (iii) high growth of mobile PCs against desktop PCs.

By year-end, Notion expects capacity for the 2.5-inch HDD components (base plates, spindle motor hubs) to reach two million per month under its first phase. Notion currently produces 400,000 to 500,000 per month for Samsung. Subsequently, the second and third phases will proceed with each phase requiring about six months each for total capacity to reach four million per month and eventually seven million per month. Management hinted that due to political uncertainties in Thailand and the need to oversee the new plant in Klang, any major expansion in the Thai plant will likely be completed only sometime in 2011. Notion is looking to expand floor space from 25,000 to 225,000 sq ft.

Orders for HDD business have been very positive so far though there was a slowdown in June. It is difficult to tell if the slowdown is simply temporary. Also, Notion is working to bring down rejection rates in its new Klang plant from 10% to 12% to 5%. In the interim, margins may be affected.

We raise FY2010/12 EPS forecasts by 3% to 5% to account for (i) the aborted private placement, (ii) higher interest costs, and (iii) dilution from the in-the-money warrants. Hence, we revise our target price from RM3.63 to RM3.74 based on an unchanged PER multiple of nine times on mid FY2010/11 earnings. We are positive that progress in the new Klang plant is on track, and believe once quality issues are ironed out, margins should improve and earnings growth should accelerate. — ECM Libra Investment Research, July 26

This article appeared in The Edge Financial Daily, July 27, 2010.

That was just last Tuesday.

Now today, ECM Libra downgraded Notion to a mere 1.85!

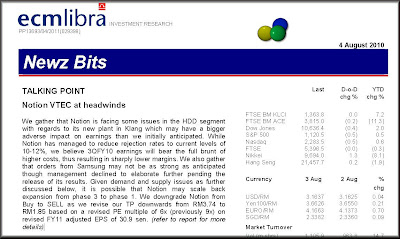

- Notion VTEC at headwinds

We gather that Notion is facing some issues in the HDD segment with regards to its new plant in Klang which may have a bigger adverse impact on earnings than we initially anticipated. While Notion has managed to reduce rejection rates to current levels of 10-12%, we believe 3QFY10 earnings will bear the full brunt of higher costs, thus resulting in sharply lower margins. We also gather that orders from Samsung may not be as strong as anticipated though management declined to elaborate further pending the release of its results. Given demand and supply issues as further discussed below, it is possible that Notion may scale back expansion from phase 3 to phase 1. We downgrade Notion from Buy to SELL as we revise our TP downwards from RM3.74 to RM1.85 based on a revised PE multiple of 6x (previously 9x) on revised FY11 adjusted EPS of 30.9 sen.

Holy cow!

That's even faster and a bigger downgrade than RHB Research!

Reasoning aside... think about it... think about the implication here on the investing public who relies on such research reports for their investing decisions.

On 27th July, ECM comments were accessible to all via the broadcast on the Edge Financial Daily: ECM Libra ups target price for Notion Vtec

Price then was 2.65. Now including 27th July, six trading days has passed since.

6 trading days.

That's all it took for ECM to downgrade Notion from a TP of 3.74 to a mere 1.85!

Holy cow!

11 comments:

Dear Moo,

This is another classic case of acting on inside info. Just wait a little and see the explosion..then ECM can claim to be hero and say 'I told u so'...

.....we would have gone broke if we listen to the impressive research done by those analysts. It seems their research is relied from single source of 'insider info' to boost share price. So...we better change their name to reporter rather than an analyst.

In components manufacturing for MNCs, 10-12% reject rates is considered high. Even 5% is high

The biggest joke is that sweet talking directors have these analysts, reporters and fund managers eating out of their hands. Believing in their fairy tales.

If you spin a story that profits are high because of a special technique that few companies in Asia possess, the sucker analysts and reporters will believe it. TYhis blog is miles better than any stupid research report.

Can someone tell me who did not rely on the "insider" of the company for an analyst to meet their deadline or whatever upgrade/downgrade?

You need the correct somebody to make you famous...haha

To this effect, I think the sectoral downgrade is not an overnight issue. Just that some kiasu analyst follow the herd mentality?? Now, becomes a real issue for the industry.

Need to pay more attention to the HDD rejection rate.

If I do recall, the Chairman is being interviewed in the 89.9 FM last couple of months....listen carefully on what he said...

I would have thought having Nikon as a strategic partner could enhance the QA?? Or perhaps not related at all because of the segmentation Nikon was at.

ronnie: Regarding the directors, great point!

But sadly some would argue and defend the directors because it's simply human nature that no directors and certainly no owners would talk bad about their own company.

solomon: The key issue was the extremely poor numbers and guidance from Western Digitzl and Seagate.

Now if the 'customers' are reporting poor numbers, surely it was natural and perhaps sensible that the analyst from RHB to downgrade Notion numbers.

Regarding Western Digital, allow me to repeat again the drastic slowdown...

Quote:

So Western Digital says it expects the coming quarter, Q1 eps to be around 80 to 90 sen.

Wastern Digital Q4 EPS was 1.23. (Street was expecting 1.35)

From an eps of 1.23 to an eps of just 80-90 sen is rather a huge decline, yes?

Some analysts blames the slower than expected ordering of HDD on ordering patterns which big customer takes advantage of the lower freight charges. Moo, yr Baltic Index wo...

Another worth to mention is the change of technologies eg a shift to more popular SSD and flash memory. Where would HDD stands later?

Interestingly, % of inventory/revenue for WD and Seagate (WD's nearest competitor) are increasing q-o-q..it makes sense to get rid of old stocks next few quarter and hence a lower pricing anticipation and weaker guidance...

on the issue of flash vs HDD, it has already surfaced before this, when flash drives were all the rage everyone was predicting HDD's demise but it made a comeback in a big way while flash maker Spansion went bust..

I think both will have its place

One of the issue here in my opinion is that I believed that everyone gave Notion an incredible outlook.

Let me paste here again...

1. RHB's 2011 net earnings forecast for Notion is 56 million. (LOL! Downgraded since then)

2. Kenanga's 2011 net earnings forecast for Notion is 62 million.

3. CIMB's 2011 net earnings forecast for Notion is 80.8 million.

4. And here comes the champion... OSK... OSK's 2011 net earnings forecast for Notion is 95.0 million.

Notion only had a net profit of 35.967 million in fy 2009.

Its trailing earnings were 50.553 milion.

So except for RHB, there's a valid arguement that perhaps the rest were way too optimistic.

Were they wrong?

Or were they wrongly guided by the management?

Post a Comment