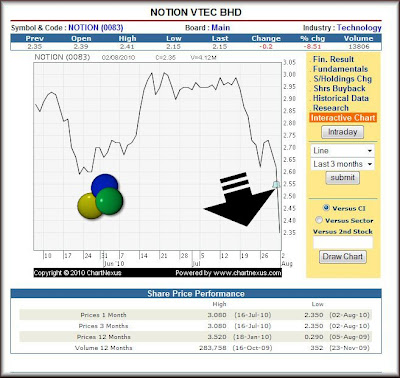

Notion the shares has been plunging and since I had made several postings on it, I thought perhaps it's best I make some comments or two on the stock.

The first thing I would always refer to is if there exist any negative news that might impact the stock.

On the Edge Financial Daily yesterday, there was this article HDD makers continue to fall

- Written by Koo Jie Ni

Monday, 02 August 2010 11:33

KUALA LUMPUR: JCY International Bhd and Notion VTec Bhd continued their downward trend last Friday, as Western Digital’s dour quarterly forecast warning sent stocks of hard-disk drive (HDD) manufacturers reeling.

JCY and Notion VTec are fellow manufacturers of HDD components, although the latter has also diversified into production of camera and automotive parts.

News reports on July 21 had it that international HDD maker Western Digital attributed its forecast profit dip to laggard spending patterns, European debt worries and lower prices....

I find it rather ironic. :D

Of course, as an investor, one would regard Western Digital's profit warning as important BUT in May 2010, Notion Vtec management did warned too regarding future profits. See posting Update On Notion VTec.

- Management warned that there is some risk that capacity ramp-up and product testing costs for its 2.5” base plate and spindle motor lines could dampen earnings in the next two quarters

And in April 2010, I blogged on the potenial earnings dilution caused by the continous share placements.

- Honey, My Notion's Earnings Per Share Has Shrunk!

- Reply To Notion's EPS Dilution Caused By Share Placements

And my concern as stated in the second posting was:

- However, let me stress that we are now looking at an increase of 29.270 million new shares, which works out to a 20.8% increase from the initial share base of 140.717 million.

And in my opinion, this is simply way too much in such a short time frame. January 2010, share base increase by 10%. Now Notion wants to increase by another 10%.

If one is a minority shareholder, what would one expect?

Which means, after these two share placements, Notion Vtec earnings has to increase by more than 20.8%, in order for the minority shareholders to see 'real growth' in their earnings per share.

Would this be possible?

Now something had happened... on the 27th July, ECM Libra ups target price for Notion Vtec

- We hosted a corporate luncheon recently for Notion VTec which was attended by a good crowd of buy-side analysts and fund managers. Management gave some good insights and outlook for the HDD business which will be the main growth driver in the coming years.

We understand from management that due to pricing issues, debt financing will be used instead. Nonetheless, the 1-for-5 free warrants exercise will proceed as planned.

So apparently, there's a chance that the second share placement would not happen.

Management said it was due to pricing issues.

But from an investing perspective or from a conservative perspective, shouldn't one question why?

Yes, besides pricing, why wasn't Notion Vtec able to perform this share placement? Why can't Notion Vtec able to attract new investors? Are the investors sceptical? Do they know something we don't?

But then of course, the 'opportunist' might say that perhaps this sell down is a 'strategy' to push down Notion Vtec's shares so that it could be able to priced out these share placements.

Well, frankly, I do not discount that. Yes, I think it's possible but if that was the case and I am the minority shareholder now, how could I possibly be happy if this was the case?

But as it is.... it's mere speculations.

Hmm... Notion Vtec was supposed to announced its earnings in July 2010. (Its previous quartely earnings was posted on 29th April 2010)

Anyway from a dilution point of view, since Notion Vtec has NOT officially announce on Bursa website in regards to the second batch of placements, I guess perhaps from an earnings dilution perspective, it's best one to remember the following table..

Discounting the warrants (lol! Did you see OSK's report on Notion Vtec dated 16th July 2010. Notion then was 2.99 and since the conversion price for the warrants was priced at 2.55, OSK shouted out very loud that one was getting free warrants that was 'in the money'! It's now 3rd August 2010, and the warrants are no longer in the money! :P), perhaps one should use 169 million shares as the potential share base for Notion Vtec. This is to prevent the investor from being shocked by the dilution in earnings.

So what did Western Digital warned about? Western Digital warns of weak Q1, shares slide

- * Q4 EPS excluding items $1.23 vs Street view for $1.35

- Western Digital executives warned that heightened competition from companies like of Hitachi and Seagate Technology (STX.O) will pressure margins, while demand in the current quarter is expected to stay weak amid economic turmoil in Europe and lackluster U.S. consumer demand

- For the current quarter, Western Digital expects revenue of $2.35 billion to $2.45 billion and earnings per share of between 80 cents and 90 cents. That is sharply below analyst expectations of $2.6 billion in revenue and earnings per share of $1.47 for the current quarter, according to Thomson

So Western Digital says it expects the coming quarter, Q1 eps to be around 80 to 90 sen.

Wastern Digital Q4 EPS was 1.23.

From an eps of 1.23 to an eps of just 80-90 sen is rather a huge decline, yes?

So that was a massive profit warning from Western Digital, yes?

And so how for Notion Vtec?

Surely there's going to be an impact yes?

And unfortunately, Notion Vtec at this moment of time, Notion VTec shares has increased and if Western Digital profit warning holds true, then do you think that there's a strong chance that Notion Vtec's EPS could see a bigger decline?

ps: This posting is as it is. I do not know if Notion will continue to fall or make a rebounce. Please contact your nearest Sotong if you really require such information.

4 comments:

Last Q-3 results were released on 18Aug2009.

Raymiond: Ah yes.

Last Q-3 announced on 18 Aug 09.

Last Q-4 announced on 10 Nov 09.

This Q-1 announced on 10 Feb 10.

This Q-2 announced on 29 Apr 10.

I guess the April one was announced early. LOL! And I have no reason why. :D

I commented on analysts and fund managers going overboard on contract manufacturers of hard disk drive components a few months ago. Could not understand why contract manufacturers enjoyed such high profit margins. A friend who is the purchasing manager of one of these HDD makers informed me that gross margins are below 6%. It is an extremely competitive business. Many analysts and fund managers are really stupid.

ronnie: my concern was on a more simplistic issue.

Growth does not last forever and when we add in the constant increment of the share base in Notion, the dilution treat will have a more damaging impact. For example, a simple 10 percent decline, coupled with a 20% dilution could really cause some intense damage if one wants to value the stock based on an earnings perspective.

Post a Comment