I do not deny that falling stocks draws a lot of interest. For many, they think it represents a chance to buy a stock at a large discount and many a times, such strategy does works.

Now if you are not aware, KNM has fallen big time yesterday.

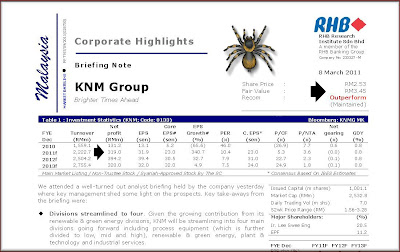

Here's a simple snapshot.

So the obvious question is KNM selldown an opportunity or what???

Are you IN it to win IT? Or are you IN it to LOSE it???

* Hehe.. where have you heard such a phrase before? *

Now if you are constant reaader of this blog (TQ!), you would realise that I offer NO direct answer to such a question. It's up to you to decide the issues highlighted in the postings.

Now as you are aware, yesterday I posted two postings. How Is KNM's Earnings Guidance Faring? and History Repeats As KNM Tanks On Extremely Weak Earnings. From the comments posted, many research houses (except for RHB) still have an extremely high Target Price for KNM.

But Encik Market apparently is not liking KNM so much after its dismal earnings report and it send KNM crashing some 15%!

So who is correct? Encik Market or Encik Research?

Now one article I noted was this from Bernama: KNM Continues To Draw Investor Interest and I saw one extremely naughty line inside! Was it a typo or was there an intent to deceive?

Quote: KNM's order book is still strong at above RM50 billion. We understand that high-end products are expected to contribute between 50-60 per cent of the total," OSK Research said in a note today.

Eh? Eh? Eh? Harloooo! Since when on earth did KNM order book is above RM 50 Biillion??????

Tsk! Is this an innocent typo or what?

I wish I have a copy of that OSK report on KNM yesterday. Anyway here's a snapshot of OSK report dated March 2011.

Quote: Both its orderbook and tenderbook are robust at RM5.4bn and RM17.0bn respectively.

And here's an article on the Edge on 9th March: KNM back to earnings guidance mode (hehe - we come back to that article later).

Quote: KNM is confident of securing higher RM3 billion to RM3.5 billion new jobs per annum in 2011 to 2012 with higher quality (thus better margin) potentials. Order book backlog now stands at RM5.4 billion,” Maybank IB research noted in its report.

So we know that KNM's existing orderbook stands around 5.4 billion and I wonder how the Bernama article has OSK saying KNM's order book is worth 50 billion!

Perhaps it's a typo and for many investors, they know order books doesn't mean much because the company still needs to turn the order book into net profits. That's what's important for them.

But of course, for the conspiracy folks and of course the flying SMS that did its round yesterday urging investors to BUY, BUY, BUY would suggest that perhaps someone doesn't want the stock to die! Hence it could be an opportunity.

Perhaps.

But perhaps it also could be the handiwork of some trapped souls.

Anyway... I always feel that it's important to know a stock history.

Now on one hand, let me say this first, knowing what has happened before would not guarantee you future success! But then history is important, no? Why do we study history in school? (ps I do not know this answer myself till this very day. I hated history. All I ever do is study dates. Why study dates? Go dating much fun, eh? :P )

Take stocks. If a stock has a long and troubled history, does it make sense to bet on it? Wouldn't the logical thing be is to find another better stock to bet on? Why force the issue?

Let's go back in time.

1 Sep 2010: Review Of KNM's Earnings

I wrote: KNM reported its earnings on 30th Aug 2010. And as expected, it wasn't nice at all.

LOL! 'And as expected'?

Well ... seriously what do you expect from the company when the management was more focused on trying to buyout the company? Yes, where is the company's focus? What's the company's priority?

Is the company focused on making more money?

Was it?

Apparently the company's management was more focused on its management buyout than its own business.

Now KNM stock is no stranger in selldowns!

The first one happened in July 2008. (sorry old Edge article. No link..)

- 22-07-2008: KNM down on financing concerns

by Jose Barrock

KUALA LUMPUR: Fast-expanding oil and gas player KNM Group Bhd continued to slide, shedding 25 sen yesterday to close at RM5.10 on concerns of its proposed exchangeable bond issue, in the current difficult period. At its lowest in intra-day trading, KNM fell to RM4.96.

The company’s shares were among the most active with 11.9 million shares traded. Since end- May this year, the company’s share has tumbled by about 27% and during the period in review, under-performed the sluggish Kuala Lumpur Composite Index by 13.5%.

According to Goldman Sachs, the dip in KNM’s shares is a result of fears as to whether the company’s proposed exchangeable bond issue will proceed, with the current weak market likely to be a dampener. KNM had taken a €350 million (RM1.8 billion) bridging loan to finance the acquisition of German-based Borsig Beteiligungsverwaltungsgeselschaft mbH, last month, and has since partially pared down some of these loans, by utilising proceeds from a RM1.1 billion one-for-four rights issue, which was completed end of last month

A month later

- 19-08-2008: KNM falls on foreign selling

by Chong Jin Hun & Jose Barrock

KUALA LUMPUR: Shares of KNM Group Bhd fell to their lowest in 10 months yesterday, on speculation that a foreign shareholder of the company is reducing its stake due to the higher political risk in the country.

This is despite the outlook of the oil and gas process equipment manufacturer being described by fund managers as bright considering that crude oil prices are expected to be sustainable in the long run.

"One of the major shareholders is selling down. It’s a portfolio change in terms of country risk," an analyst told The Edge Financial Daily yesterday.

A fund manager said KNM’s fundamentals remain intact in the long term because oil prices are expected to be sustainable, albeit at a lower level. KNM officials declined to comment when contacted.

Yesterday, shares of KNM dropped 11% or 18 sen to finish at RM1.46 with 32.99 million shares done. The stock traded at a daily high of RM1.64 at 9am, and sank as low as RM1.38 as at 2.44pm. Shares of KNM which have declined 37.74% this year, touched a one-year high of RM2.48 on Jan 2 this year, and hit its yearly low of RM1.23 on Aug 21 2007.

Volume has also increased significantly since last Friday. A total of 15.3 million shares were traded last Friday and another 33 million traded yesterday.

Filings to Bursa Malaysia show that US-based FMR LLC, and Bermuda-registered FIL Ltd (Fidelity International Ltd) have sold down their equity interest in KNM. Both FMR and FIL had disposed of 6.55 million shares in KNM between Aug 4 and 12 this year. According to filings, Fidelity still has another 407 million shares representing 10.29% of the company.

It could not be determined if Fidelity was a major seller of the shares yesterday...

A month later: KNM shares at 12-month low

- ... The company’s shares closed at RM1.24 yesterday.

Chong said although there was renewed concern surrounding the intangibles, there was “little risk of write-downs despite the current macro environment”.

“KNM is working with its auditors on how much they can revalue Borsig’s fixed assets and intellectual property,” he said.

He added that the current valuation of 2.33 million euros for plant and machinery did not include intellectual property.

Chong said the plants and intellectual property could be valued as much as 170 million euros (RM800mil) due to the latest robotic equipment and 19 different design patents that generated most of Borsig’s revenue.

“If Borsig’s fixed assets and patents are revalued upwards, this means that the RM1.6bil intangibles on KNM’s balance sheet will be reduced to RM800mil.

Let me paste the following here:

The following was most interesting

- Acquired 23/10/2008 11,376,000

Disposed 16/10/2008 72,271,600

Disposal was massive!

And did you see the point 2? Disposal of 72,271,600 shares - sold down by financier which is now resolved

And more interestingly, the company DID a share buyback during this same period! Notice of Shares Buy Back by a Company pursuant to Form 28A

Look at the details

Date of buy back from : 16/10/2008

Date of buy back to : 22/10/2008

Total number of shares purchased (units) : 22,190,200

Minimum price paid for each share purchased (RM) : 0.415

Maximum price paid for each share purchased (RM) : 0.690

Total amount paid for shares purchased (RM) : 13,544,216.13

Er how? The boss shares were sold down by his financier and during this exact same period, the company bought back shares!

Like this also can meh? (Of course the share bought back brought 'stability' to the share price. Look at the min and max price paid for the share buybacks!

But for some traders, they just love such stuff!

No joke!

Forward to 2009. On March 17th 2009, Management buyout of KNM hinges on funds

Massive privatisation talks via a MBO is been prmoted by the MD.

- A management buyout (MBO) will be considered for KNM Group Bhd but funding must be available, said managing director Lee Swee Eng.

“In the current environment, it will be very difficult to raise funds,” Lee told StarBiz in reference to a Bloomberg report on the possible privatisation of the company.

A Bloomberg report yesterday quoted Lee as saying he would consider leading an MBO as long as banks will the funds.“We are very undervalued. The opportunity for privatisation is a good opportunity but it’s the source of funding. There is no offer on the table,” he was quoted as saying.

Straight from the horse mouth. KNM is very much undervalued.

Wednesday, 10 June 2009, the Edge Financial Daily publishes the following. KNM’s MD sells 63.65m shares

- KUALA LUMPUR: KNM Group Bhd managing director Lee Swee Eng’s selling of a 1.6% stake recently has raised eyebrows and concerns about whether he would continue to pare his interest in the oil and gas player.

Replying to queries by The Edge Financial Daily via SMS yesterday, he said the selling of the shares was a strategic placement. “The proceeds from it will be used to degear and clear up all the margin taken up during the rights issue,” he said, but mum on whether he would be selling more shares.

According to a Bursa Malaysia filing on Monday, Lee sold a total of 63.65 million shares representing a 1.6% stake in KNM between June 1 and 4 at prices ranging from 97.5 sen to RM1.02 apiece.

Lee still holds a 23.74% stake in KNM as at June 8, via direct and indirect interests. While there were no new filings on Bursa regarding substantial shareholding changes in KNM yesterday, the company did see a block of 10 million shares change hands off-market yesterday in a block deal, at RM1.03 per share.

The stock had hit a six-month high of RM1.06 last Friday. It was the most actively traded stock yesterday with 82.64 million shares done, closing one sen lower at RM1.03.

“We believe that the share sale may help to raise funds to redeem part of Lee’s holdings under a share margin account,” said HwangDBS Vickers Research in a report yesterday.

The research firm pointed out that in October last year, Lee had been forced to sell a portion of his KNM shares by CIMB Bank. It was the fear of margin calls that had caused the company’s share price to drop during that period.

“We understand that the shares (the block sold in October 2008) was under share margin financing. This time around, the share sale is not under forced selling but Lee has raised around RM64 million and this could be used to redeem his holdings,” said HwangDBS.

Ahem.. see how KNM the stock had recovered? If you were a trader, wouldn't you love KNM so much?

But if you are a minority shareholder, think for a moment. Perhaps I am flawed in my way of thinking. Well acordingly the initial sell down was because of Lee's share margin financing.

And KNM the stock got hit big time!

Poor minority shareholders who had to suffer the selldown just because the MD's shares were sold down!

Come March, the MD starts to promote his shares stating KNM were very much undervalued.

So cheap that he wanted to do a privatisation via a MBO.

Then the markets rallied worldwide.

And KNM shares soared too.

Everyone was happy.

The MD Lee was even more happy and KNM did not seem undervalue no more, as he disposed a chunk of his shares and according to HwangDBS his disposal of shares helped rake in a tidy rm64 million ringgit!

How's that for cool?

And what about the MBO?

Guess what? On 15 April 2010: KNM's MBO Fails

Sorry but looking at it now, perhaps one would ask if there was any real intent to do the MBO.

And then there were many who simply wished that the MBO was real!!!

26 May 2010: Oh KNM, Can You Please Buyout The Company At 90 Sen?

With all these behind, KNM starts talking. The boss starts talking about 'swelling' orderbooks! It was unreal talk for those who had kept track of its orderbook. See posting: KNM: I Just Love The Way The Boss Talks!

And then the Boss continues to talk!

On 1 March 2011: KNM Says It Wants To Buy More Foreign Firms And Expand.. . And some were amazed by such talk because as per its balance sheet then, it did not appear that KNM was strong enough to buy more foreign firms.

A week later KNM started giving earnings guidance again. See What I Think Of KNM's Earnings Guidance

Now earnings guidance is important. It tells the local research house what to expect from the companies earnings. It's an indicating tool for the analyst and they use it as one of the basis on how they value the stock.

Naturally the higher the earnings guidance, the better for the stock.

Simplicity.

Higher earnings guidance means higher future earnings per share, which eventually means higher stock price.

And as mentioned before, in my usual flawed and wrong opinion, if a CEO or management opens its mouth and guides its earnings, I believe that the analyst/research reports have no choice and they have use that GUIDANCE number!

This is what the INSIDER, the CEO, the TAIKOR is telling them. The analyst cannot simply say, 'Oh no, dear Bossie, your GUIDANCE numbers are very rocket. There's no way your company can achieve those numbers!!!!'.

It's like telling the CEOs they are BS-ing! They simply cannot do that, can they?

And now that they do follow the guided numbers and when the actual earnings are way below estimates, the analysts would probbly feel silly.

Now the issue is with KNM's earnings guidance.

KNM did not have a good track record when they give earnings guidance.

Anyway as per the March posting: What I Think Of KNM's Earnings Guidance

Let's compare KNM's guidance previously and compare to what KNM actually earned.

Such comparison should be useful, yes? At least we get to know the quality of KNM's earnings guidance.

So how did KNM do?

fy 2008, KNM made 336.175 million. (KNM guided 450 million)

fy 2009, KNM made 257.847 million. (KMM guided 700 million)

Now on March 2011, earnings guidance, KNM said "KNM’s management had met with analysts earlier in the week and guided earnings before interest, tax, depreciation and amortisation (Ebitda) of RM363 million for its FY11 (ending Dec 31, 2011), while the Ebitda for FY12 is targeted at RM564 million."

And with such guidance, research house like RHB gave an earnings forecast of 319 million for FY 2011 for KNM. And naturally RHB gave it an OUTPERFORM rating.

How did KNM do for the first quarter? "The Group achieved revenue of RM413.00 million, profit after tax and minority interest of RM19.02 million and EBITDA (Earning Before Interest, Tax, Depreciation and Amortisation) of RM39.89 million for the period ended 31 March 2011.."

KNM's profit before tax for FY 2011 Q1 was only 6.267 million. ( I am ignoring the tax incentive ANGPOW given to KNM!) (ps: with such booming eps, how much do you think KNM can earn this year?)

And RHB was less than impressed too! "1QFY11 PBT of RM6.3m was significantly below expectations, accounting for only 2.3% and 3% of both our (RM277.5m) and consensus (RM208.9m) estimates respectively."

How?

And oh.. the goodwill issue. It's just some 832 million worth of goodwill sitting inside KNM's books. Why? I don't know.

So how lah?

Based on all these, do you want to bet on this stock or not?

I don't know Teochew music but I know some Hainan music. Can ah?

1 comments:

Analysts trim KNM forecast but upbeat on prospects

By Sharen Kaur Published: 2011/05/28

KUALA LUMPUR: Analysts have trimmed their net profit forecast for oil and gas process equipment maker KNM Group Bhd, although they are upbeat on its prospects.

They are concerned about KNM's legacy contracts that are eating into its margins.

KNM has substantial amount of contracts from early 2010, which it has yet to account for. This led analysts to believe that another quarter of sluggish earnings is likely.

"We can't foresee how much longer these contracts would exist and we lack visibility as to when the 2010 cost overruns will end," said an analyst with RHB Research Institute.

The share price of KNM, which is 11.76 per cent owned by the Employees Provident Fund, yesterday fell the most in three weeks after the company reported a drop in first quarter earnings. The stock fell 15 per cent yesterday to close at RM2.15, with 1.03 billion shares traded.

For the quarter ended March 31 2011, KNM's year-on-year net profit fell by half to RM19.02 million. The earnings include tax incentives of RM12.8 million.

RHB Research has cut KNM's core net profit estimates to RM135 million for fiscal 2011 from RM230 million.

It has downgraded the stock to "underperform" from "outperform" and cut the price target to RM2.28 from RM3.45.

An analyst at TA Securities said KNM may do better in the second half of the year, led by its RM2.2 billion UK project.

Last December, KNM won a contract for biomass and waste recycling and has started preliminary engineering works.

TA Securities has a "buy" call on the stock with a target price of RM4.27 as it thinks the UK project will propel its margin game as it is on a cost plus basis.

The research house is also bullish because of KNM's strong order book of RM5.4 billion.

"KNM needs to address its cost overrun issues and operating margin, which has fallen by 1.2 per cent. This is the worrying factor," the analyst said.

A foreign broker, however, does not think the UK project would contribute as much to its earnings as it would be offset by losses from older projects.

"KNM should recognise 15 per cent or RM300 million of the project value this year but it is not enough to boost earnings as a lot of their older projects are eating into their margins," he told Business Times

Post a Comment