Genting Malaysia or Resorts World is slammed down again!

Why? Yet another Related Party Transactions (RPT) !!!!

On Star Business: Genting buys UK casino businesses for RM1.7b

- Genting Malaysia Bhd will acquire its Singapore affiliate’s casino businesses in Britain for £340mil (about RM1.67bil)...

Now for a RM 1.67 Billion transaction, I felt utterly disgusted that the news article did not mention how Genting Uk is faring as a business.

For the less savy investing public, what good is that article?

Here is the Bursa announcement: GENTING MALAYSIA BERHAD PROPOSED ACQUISITION OF GENTING SINGAPORE PLC’S CASINO BUSINESSES IN THE UNITED KINGDOM FOR A TOTAL CASH CONSIDERATION OF £340 MILLION.

Now if the investor opens the pdf file attached: Ann - 01072010.pdf

- On behalf of Genting Malaysia Berhad (“GENM”)’s Board of Directors (“Board”), we wish to announce that Genting Worldwide (UK) Limited (formerly known as Feste Limited) (“GWWUK”), a wholly-owned subsidiary of Genting Worldwide Limited which in turn is a wholly-owned subsidiary of GENM, has on 1 July 2010 entered into a conditional sale and purchase agreement (“SPA”) with Genting Singapore PLC (“GENS”) to acquire from GENS its100% equity interests in Nedby Limited (“Nedby”), Palomino Star Limited (“PSL”), Palomino World Limited (“PWL”) and Genting International Enterprises (Singapore) Pte Ltd (“GIESPL”) for a total cash consideration of £340 million (“Proposed Acquisition”).

Here is Nedby's proforma...

Genting Malaysia only supplies that info? Is that enough? Why no 2007 numbers? Why no 2008 numbers?

Anyway.. current 3 months of fy 2010... Nedby lost some £194 million. And has some £ 64.3 million in borrowings.

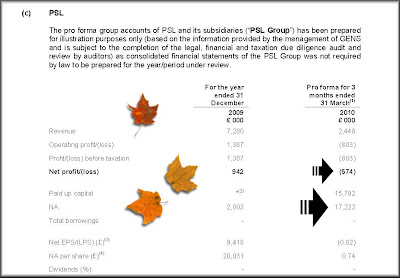

Here is PSL's proforma.

Not much losses.. no loans.

PWL...

- PWL and its subsidiary Palomino World (UK) Limited (“PWL Group”) have not commenced operations as at 31 March 2010. Based on the pro forma group accounts of the PWL Group as at 31 March 2010, the PWL Group has NA of £113,008 (based on the information provided by the management of GENS and is subject to the completion of the legal, financial and taxation due diligence audit and review by auditors).

And here is GIESPL

Barely profitable and GIESPL carris some £34.825 million in loans.

Which gives the total group bought by Genting Malaysia the following numbers...

In layman's term, Genting Malaysia bought from it's associate company, Genting Singapore, (yes, some call this as a related party transaction, where one company within a group, sells to another, or some would crudely say, 'left hand sell to right hand') its casino business in UK.

Sum to be paid? £340million.

What do shareholders of Genting Malaysia get in return?

Genting Uk, current 3 months of THIS fiscal year, is losing some £184.625mil and this company carries some £99 mil in borrowings!

Gee it would be nice if Star Business prints out this FINE detail of the transaction, yes?

So does it make sense?

Oh yeah... since it's related business, some would crudely call it a BAILOUT!

And best of it all, I saw the following news flash...- DJ MARKET TALK: Genting Singapore +1.7%; Fortunate UK Exit -Citi

Dow Jones Newswires 02 Jul 2010 9:50am

0150 GMT [Dow Jones] Genting Singapore (G13.SG) +1.7% at S$1.20 as proposed GBP340 million (S$688.8 million) sale of money-losing U.K. operations to sister company Genting Malaysia (4715.KU) fuels hopes for stronger earnings profile. While Genting Singapore will book FX translation loss of S$338 million this year, bottom-line excluding exceptional item expected to improve. "Considering that the U.K. gaming operating business remains very tough, we view this exit as an escape for Genting Singapore and we view it as fortunate in that there was a buyer in the market," says Citigroup; "it means Genting U.K. will no longer drag on the performance of Resorts World Sentosa." Still, keeps Sell call, S$0.65 target on valuation grounds. Orderbook quotes suggest minimal upside beyond S$1.23. (frankie.ho@dowjones.com)

!!!!

Yup! Genting Singapore shares rose! And Genting Malaysia got hammered! And note the comments in red...

- "Considering that the U.K. gaming operating business remains very tough, we view this exit as an escape for Genting Singapore and we view it as fortunate in that there was a buyer in the market," says Citigroup; "it means Genting U.K. will no longer drag on the performance of Resorts World Sentosa."

How FORTUNATE!

The buyer is the related Genting Malaysia!

How FORTUNATE!

Need I say more?Oh yeah, I must sress that since it's FORTUNATE for Genting Singapore... it surely means ... how UN FORTUNATE for Genting Malaysia!

And seriously, I do not feel sorry for the minority shareholders in Genting Malaysia.

Seriously I don't.

Look this related party transaction thing had been happening over and over and over again!

Posted Dec 2009. (Yeah... Dec 2009 and its now only Jul 2010 and Genting Malaysia has oops and done it all over again!) MSWG Slams Genting Malaysia For Its RPT Land Deal!

- Some investors do not forget about poor corporate governance. It takes away the issue of 'trust' in one's investment.

Put it this way. Investment usually takes a much longer time frame before one reaps the profit and during this 'longer' time frame, the investor would not like to see poor corporate governance issues involving RPT because they know each RPT (how could a transaction/deal make sense when the 'left hand' sells to the 'right hand') could cause the stock to get a hammering in the market. Now if one cannot 'trust' the company, then how could one have the guarantee of not enduring yet another RPT transaction from the company? And how many RPTs have we seen from Genting group recently? Did one forget the last one? And does a leopard ever lose its spots?

And seriously, Genting Malaysia, do show some respect to your minority shareholders!

Blogged recently: Genting Malaysia Buys Properties From Genting Bhd

ps. back then.. the stock got hammered. Today, the stock got hammered again! Groundhog day?

ps: remember 2008? remember Walker Digital Gaming LLC (WDG) fisaco? (ps who owns WDG?)

ps: Buy Genting Malaysia because of it's massive cash war chest? Well, what good is such a war chest to the minority shareholder when the company keeps making such acquisitions?

4 comments:

this is why cash-rich companies are not a sure buy if they are not transparent with how they use their money..

after years of miniscule dividends the shareholders get screwed with another RPT

but ... sadly.... ppl still BUY such stocks.

I wonder why.

I think this is a good buy for 5 year or more perspective, business wise. I mean gaming biz cann't spread their wings in a country which predominantly is Muslim. Over the years, you need to be in non Muslim states if you want to go far here.

Or maybe, the GM board should give the minority a chance for a decent and better dividend since everyone thought the company is sitting on fat warchest? Or they should be little bit more conservative in putting all the money in one venture?

LOL! I seriously, seriously, seriously beg to differ. :P

A. It's a related party transaction.

B. It's a related party transaction.

C. It's a related party transaction.

D. It's a related party transaction.

E. It's a related party transaction.

F. It's a related party transaction.

.

.

.

.

.

.

.

Post a Comment