Saw the following article on Star Business: Prudential UK eyes P&O takeover

Now before I read what the article was saying, I was aware that K&N had dona a stock analysis (initiated coverage) on the stock back on 22nd July 2010 and I was well aware that the stock literally flew into the orbit.

Yeah... you know and I know... if you are reading this right now... LOL!... you are rather LATE into the party.

Don't believe?

Think I am being nasty and so black hearted and I am attempting to stop you from seeking next week's fortunes in the stock market? Well take a look...

The stock was just 0.585 sen on 21 Jul 2010. The stock last traded at 0.925 on Friday. (ps: K&N initiated coverage on P&O when the stock was trading at 63 sen. Target price stated was 1.65!! :D)

And so after the stock is well into orbit, the local media is only promoting the stock now.

How?

Could it go much higher?

And how high?

:D

I then proceeded to read what the mighty pen from our local press has to write...

- PETALING JAYA: Prudential UK is believed to have submitted an application to Bank Negara to commence talks on the potential acquisition of local general insurance company, Pacific & Orient Bhd (P&O).

However, the details of the potential merger and acquisition (M&A) exercise between the two parties were still unclear....

'Is believed'? LOL! Who is believing this? And yeah... details of the M&A is... STILL UNCLEAR!

LOL!

- This has added fuel to recent market talk that P&O had emerged on the radar of potential buyers.

Well? This Star 'financial' news article is sure adding the fuel! :D

- According to Kenanga Research, the owner was contemplating a divestment in P&O in a deal that could reap proceeds that were well above P&O’s implied stock market valuations.

Chan Thye Seng, the managing director and chief executive officer of P&O, holds a 51.4% stake in the company.

When contacted, P&O declined to comment on the matter.

When contacted, a spokesperson from Prudential Malaysia said it did not comment on market speculation.

Ah.. the K&N article ( let's see that later ) ... but ... how ironic... here we have a stock that is flying off into the orbit... and the two parties speculated to be involved in a M&A is declining to comment on the..... market speculation.

LOL!

- “Having undergone a massive change in business direction over the last two years, P&O has engineered a major turnaround in profitability,” said Kenanga in a recent report.

P&O returned to the black in the previous financial year ended Sept 30, 2009, with a net profit of RM14.9mil compared with a net loss of RM32.6mil the year before.

But, for the first six months of the current financial year, P&O slipped back into the red with a net loss of RM1.4mil compared with a net loss of RM6.1mil in the previous corresponding period.

Ah... A turnaround stock... but ... but... but... it's conflicting... :P

Look at what K&N is saying... 2008 it was losing money.. 2009 it returned to the black.. BUT.. the first half of the year... P&O is losing money again.

How would you define it?

Me?

I see a possible turnaround.. but...with P&O losing money again the first half of the current fiscal year.. I reckon it would be best that I not used that word 'turnaround'... and I would certainly not boldly call it 'a “ major turnaround in profitability” like how K&N did.

- As at March 30, 2010, its net asset per share was RM1.34.

P&O’s main focus is on two core areas – financial services and information technology (IT).

Huhu!

Net asset per share was rm 1.34 as at 30th March 2010?? LOL! K&N Target price is 1.65! More than the net asset per share! No wonder this stock is so 'powderful' the past couple of days. :D

(ps: buy on rumours? Sell on news? :P )

Time to dig out that K&N report... (ps: this is a 15 page report. The longer the better eh? :P )

- Extremely cheap valuations. P&O is trading at 3x FY11 PER and 0.55x P/BV. There could be upside to our profit forecasts as our investment assumptions of 2.5% Fixed Deposit yields are fairly prudent to account for its RM900m near cash holding.

Huhu!

rm900 million near cash holding??????

Where are all the 'value investors'?

Time to check out some announcements on Bursa website.. ( ahh.. recently.. a stock split Entitlement - Others )

Here's P&O quarterly earnings reported in May 2010: Quarterly rpt on consolidated results for the financial period ended 31/3/2010

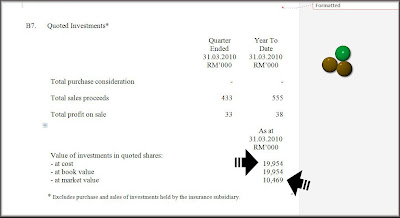

Here's a screenshot of its balance sheet asset...

hmm.. maybe I cannot understand K&N's statement "There could be upside to our profit forecasts as our investment assumptions of 2.5% Fixed Deposit yields are fairly prudent to account for its RM900m near cash holding." since I cannot find where the 900 million...

Let's look at the extremely 'cheap' reasoning from K&N again.

- Extremely cheap valuations. P&O is trading at 3x FY11 PER and 0.55x P/BV

Now... let me say again... of course I believe that a company should be valued based on what it can earn in the future. Yes... future earnings are very important...

But... but.... this is where it gets tricky.. and this is where the investing public can be fed with the incredible sky high earnings estimates... which inadvertently does make a stock appear extremely cheap. :P

Here's K&N estimates...

You need to click on the image to see a clearer and bigger view. :D

Anyway.. from the table... KN said P&O is projected to earn some 32.87 million for this current fiscal year 2010.

Well.. remember the Star Business article earlier? K&N acknowledged that for the first half of the current fiscal year, P&O have a current net lost of 1.4 million.

Now let's look at P&O announcements on Bursa website.

- May 2010: Quarterly rpt on consolidated results for the financial period ended 31/3/2010 - P&O made 3.247 million for the quarter. - Current half year losses were 1.417 million. (as stated by K&N)

- Feb 2010: Quarterly rpt on consolidated results for the financial period ended 31/12/2009 - P&O stated it lost 21.352 million for the quarter!

Now this is where I am so lost ( Yeah.. what to do since I am not an accounting expert. :P ) and confused. Q1 in Feb 2010, P&O said it lost some 21.352 million. Q2 it said it made some 3.247 million. But.. it's half year total losses was only 1.417 million.

Me? I am so lost. :P

Anway... here's a couple more quarterly earnings from P&O.

- Nov 2009: Quarterly rpt on consolidated results for the financial period ended 30/9/2009

- Aug 2009: Quarterly rpt on consolidated results for the financial period ended 30/6/2009

Now using the current 2010 half year net loss of reference, K&N had estimated P&O earnings for fy 2010 to be 32.87 million.

Now I know, earnings projections and estimates, are incredibly difficult. More so for me, since I am not a Sotong. :P

But... an earnings estimates of 32.87 million when the company is sitting on half year losses of 1.4 million???

Surely that's a bit too optimistic, yes?

yeah... from K&N earnings estimate table.. we see K&N using a PAT (profit after tax) growth estimate of 120%!!!

a 120% growth estimate!

huhu!

Rather incredible eh? Considering the fact P&O made 14.9 million and current half year it is losing 1.4 million. But yet, K&N states it can achieve an earnings growth of 120%!!!

huhu!

But... KN did NOT say P&O is cheap based on 2010 figures!

Instead K&N states P&O is cheap based on 2011 figures!

And what is K&N earning estimates for P&O again? 43.47 million!!!!

huhu!

Wiki Wiki!

And as stated in the earnings estimate table... this is an PAT growth estimate of 32%!

How?

Yeah babe. K&N is saying P&O is cheap based on this 2011 earnings. Only trading at 3x PE multiple based on 2011 earnings!!!

I just love how they do it.

:D

- 92% upside to base case valuation of RM 1.15. This values the group at an undemanding FY11 PER of 6x, which is at the low end of the 6-15x 2010/11 PER of Malaysian general insurers.

- M&As valuation of RM 1.65 (translating to 4.2x). Although there is already substantial price upside to our base case valuation, the stock is worth even more on M&As basis. Our M&As values P&O’s in range of 1.5-2.0x FY11 P/B V, which is in comparison with first phase consolidation of Malaysian banking sector.

waa.... two type of valuations. Base case valuation of rm 1.15 and M&A valuation of rm 1.65!

Terror la!

:P

Then I reminded myself that K&N report is a 15 page report! oO

Do I want to go thru it all?

Nah....

so how?

Would P&O continue its fly up, up and away?

Seriously? I do not know.

----------------

ADDUM:

regarding the 900 million near cash holding... on page 10 of the report.

- Investment Gain. However, in view of the group’s potential earnings volatility, we have factored in some prudent investment yield assumptions in our forecasts.

For example, the yield for the group’s investment portfolio could be higher than we have assumed of 2.4% which attached to only 6-months Fixed Deposit rates. Its RM900m near cash/ all cash position, may generate bigger profits if increase equity exposure in any market dips rather than the small profit that we are projecting. In addition, our projected rise 2.4% yield to its RM900m cash for FY11 could prove conservative, as it is slightly lower than market expectation.

Hmm... let me look at May's earnings again: Quarterly rpt on consolidated results for the financial period ended 31/3/2010

How?

Oh.. ps: P&O does do some money lending business too. :P

- Pursuant to paragraph 8.23(2)(e) of the Main Market Listing Requirements of Bursa Malaysia Securities Berhad, the Company wishes to announce the moneylending activities (as part of the ordinary course of business) of its wholly-owned subsidiary, P & O Capital Sdn Bhd for the second quarter ended 31 March 2010, as set out in the attachment.

POB~POC (2Q 2010).doc

15 comments:

Perhaps they assume that the non-liquid asset/investments around RM800M will yield 2.5% and are equivalent to liquid cash..

Kris: Perhaps that's possible but

but if that's the assumption made and since this is an investment report, don't you reckon that K&N owes it to their investors to give a rather more clear statement than just saying 'There could be upside to our profit forecasts as our investment assumptions of 2.5% Fixed Deposit yields are fairly prudent to account for its RM900m near cash holding.'?

Oh... they did explain it. I am sorry.

Page 10.

>>>>>>>>>

Investment Gain. However, in view of the group’s potential earnings volatility, we have factored in some prudent investment yield assumptions in our forecasts.

For example, the yield for the group’s investment portfolio could be higher than we have assumed of 2.4% which attached to only 6-months Fixed Deposit rates. Its RM900m near cash/ all cash position, may generate bigger profits if increase equity exposure in any market dips rather than the small profit that we are projecting. In addition, our projected rise 2.4% yield to its RM900m cash for FY11 could prove conservative, as it is slightly lower than market expectation.

Kris: Added and edited the posting. :D

lol, K&N thinks that they are they next SOTONG in KLSE!

BTW, I wonder why you always continue to dig even you know a stock is a loser? It make more sense if you can short it but you can't.

lol, K&N thinks that they are they next SOTONG in KLSE!

BTW, I wonder why you always continue to dig even you know a stock is a loser? It make more sense if you can short it but you can't.

AhYap: Why I always dig?

Now that's a good question, in which I don't have an answer. :D

ps: in the stock market anything can happen. :D

And I do have to give K&N credit.. when it wrote P& was only 63 sen. :P

Is this company something different from Kurnia Asia?

In term market share or revenue, I presume Kurnia Asia would be better off than P&O. What is the big deal here?

If an auntie can tell me what is P&O today by sudden, I think one should be extremely careful on the share price movement...maybe the digger will give it a miss, I will too.

LOL!

Which auntie?

:P

oh yes, which auntie r u referring to?

auntie m? like in james bond?

hahaha!

That Auntie M very the powderful leh!

:P

Solomon,

You can change the statement to

"If a SOTONG can tell me what is P&O today by sudden,"

Hahaha..we now know SOTONG oracle is good in predictions.. :P

You might be right and wrong here. Sotong can predict the WC. In Malaysia, Auntie can predict the stock ending result.....especially those Siew Lai Lai who plays mahjong with maids serving them during the weekends....

Never mind what it is called, a cat that can catch rat is a good cat?? Does it applies here when its share price continue to climb while the "good" fundamental remains??

If I am one of the tentacles of the SOTONG, I would say Properties stock will outperform next week, can I??

LOL!

Hmm... I need to know more Aunties!

*grins*

And oh.. you do know grilled SOTONG with a tinge of Wasabe is simply SUPERB!

:D

Post a Comment